Your go-to money

innovators team up.

Get the confidence, knowledge and tools you need to feel better about any financial topic with Intuit Credit Karma.

Image: 6100_CO_LP_002_NP-Podcast_D

Image: 6100_CO_LP_002_NP-Podcast_D Image: 6100_CO_LP_CCMarketplace_D

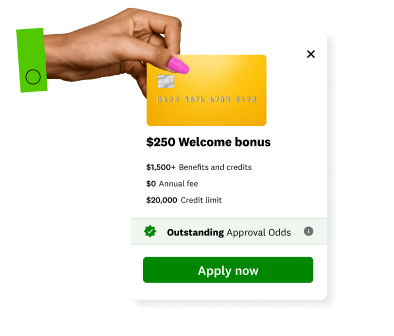

Image: 6100_CO_LP_CCMarketplace_DFind the right credit card for you

See personalized recommendations that fit your credit profile to find the right card for you. Check out your offers and Approval Odds2 before you apply.

Image: 6100_CO_LP_CreditBuilder_D

Image: 6100_CO_LP_CreditBuilder_DLevel Up with Credit Builder

With Credit Builder, you could raise your score by an average of 21 points in 3 days1. Build credit and savings at the same time.

Credit Builder requires a connected external bank account, connected paycheck, or one-time direct deposit of at least $750 into Spend account. Members with a credit score of 619 or under may see an increase in 3 days of activating the plan. Other factors can impact your score.

Image: Untitled-1

Image: Untitled-1Episode 1:

How to find the right credit card (and perks!) for you.

Image: Untitled-1

Image: Untitled-1Episode 2:

Hear how you could improve a low credit score by an average of 21 points in 3 days.

1From December 2023 to April 2024, members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 21 points in 3 days of activating the plan. Late payments and other factors can have a negative impact on your score, including activity with your other credit accounts.

2Approval Odds are not a guarantee of approval. Credit Karma determines Approval Odds by comparing your credit profile to other Credit Karma members who were approved for the card shown, or whether you meet certain criteria determined by the lender. Of course, there’s no such thing as a sure thing, but knowing your Approval Odds may help you narrow down your choices. For example, you may not be approved because you don’t meet the lender’s “ability to pay standard” after they verify your income and employment; or, you already have the maximum number of accounts with that specific lender.