September 21, 2016

Americans are shopping again and they are increasingly charging it. Growth in credit card and auto loan debt added to the $35 billion increase in aggregate household debt for a total of $12.29 trillion at the end of June according to government reports.

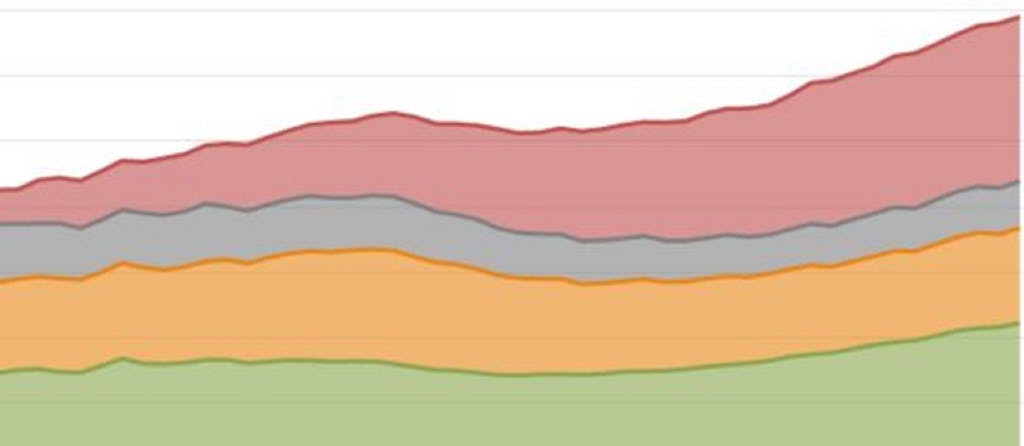

The Federal Reserve Bank of New York Center for Microeconomic Data reported in August that aggregate household debt balances at the end of June increased 3% from the end of March. Still, overall household debt is 3.1% below its peak of $12.68 trillion in the third quarter of 2008 just before the start of the recession. After a long, slow climb, the debt level is now 10.2% above the lowest level in the middle of 2013.

This was not an example of people rushing out to buy houses and take on second mortgages. In fact, consumer credit reports show that at the end of June, the total mortgage debt in the U.S. actually fell $7 billion from the previous quarter for a total of $8.36 trillion. Balances on home equity lines of credit fell by the same amount to $478 billion.

The jump in household debt came from an increase of $32 billion in auto loan debt and $17 billion in credit card debt nationwide from the previous quarter. Some areas of the country contributed more per person to that debt load than others. According to trends seen in the aggregate records of millions of visitors to Credit Karma between June 1 and June 30, the average auto loan in America was $18,049. Texans who financed their cars carried the largest auto loans on average with $22,816 per person. They were followed by Wyoming where the average auto loan for those who had one was $22,633. The states with the lowest outstanding auto loan debt per person who financed their car were Michigan with $13,546 and Rhode Island with $14,255.

Average amounts of credit card debt also varied pretty drastically by state. Over that same time period, credit card debt for those with an open card was $5,101 nationwide. Alaska led the way with an average of $6,087 in credit card debt per person with an open card, followed by Hawaii with $5,978. The states with the lowest credit card debt per person with an open card were Mississippi and Iowa with $4,025 and $4,308 owed respectively.

New York Fed Research Officer Donghoon Lee saw the report as a positive reflection of the direction of the economy. “Today’s report highlights a positive ongoing trend in household debt. Delinquency rates continue to improve, even as credit has become more widely available.”