In a Nutshell

You can get your free VantageScore 3.0® credit scores from Equifax and TransUnion on Credit Karma. But if you want to get your FICO® scores from Experian, you have options for a fee, or even free.If you’re a member, Credit Karma offers your free VantageScore 3.0® credit scores from Equifax and TransUnion. But what about your free Experian credit score?

If you’re looking for your Experian FICO® score, read on to learn where to find it as well as the difference between the VantageScore and FICO scoring models that lenders typically use.

- Where can I get my free Experian FICO scores?

- What about paying for my Experian credit scores?

- What is a good Experian FICO score?

- Will checking my scores hurt my credit?

- What are the different credit-scoring models?

- What factors make up my credit scores?

Where can I get my free Experian FICO scores?

Free options

Under the Fair Credit Reporting Act, you have the right to periodically get your credit report from each of the three major consumer credit bureaus for free. But under the FCRA, each of the bureaus is allowed to charge a reasonable fee for your scores.

With that in mind, here are some ways to access your FICO scores from Experian.

You have a few ways to get your credit scores for free. The Federal Trade Commission has information on getting your free credit reports from all three bureaus through annualcreditreport.com, but this won’t necessarily include your credit scores.

If you’d rather go through Experian directly for your credit report information, you could create an account to check your credit reports and credit scores for updates every 30 days when signing in free of charge through its CreditWorks℠ Basic service.

Another free alternative for checking your FICO score is freecreditscore.com. The Experian-owned and -operated service allows you to check your Experian credit report and FICO score, based on the FICO Score 8 model, every 30 days.

Your credit card issuer may also provide your credit scores for free, though which scores, if any, are displayed varies depending on which credit card company you use. For example, American Express and Discover offer TransUnion credit scores, and Chase offers credit monitoring to identify potential identity theft or other fraud.

What about paying for my Experian credit scores?

To view your FICO scores via Experian more than once a month, you can sign up for monitoring services like Experian CreditWorks℠ Premium. This paid service — which has a free 7-day trial and then costs $24.99 a month after that — allows you to see your FICO scores from the other two major credit bureaus and offers tools for better understanding your credit.

You can also access your FICO scores from Experian via myFICO.com for a monthly fee that ranges from $0 for its Basic plan to $39.95 for its Premier plan, depending on whether you want reports from all three main consumer credit bureaus or just from Experian. The plans also offer features such as credit monitoring and identify theft insurance.

What is a good Experian FICO score?

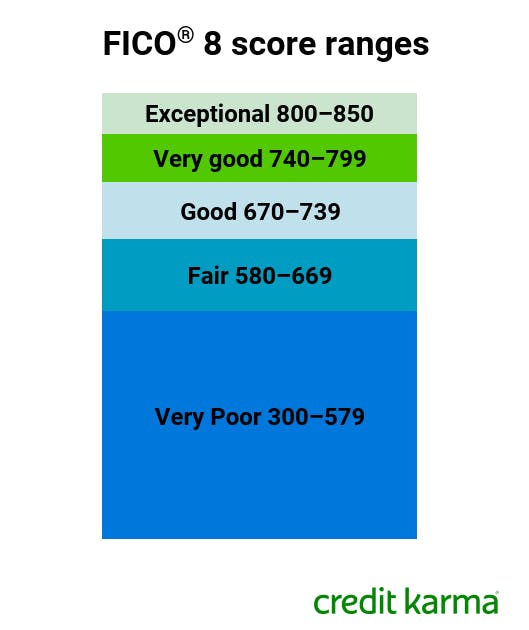

A good Experian FICO score is considered to be 670 or better when looking at the FICO 8 scoring model. The chart below shows the ranges of credit scores from poor to excellent.

It’s important to know your credit score and what a good credit score is because having a poor or fair Experian credit score could cost you — lenders may be reluctant to give you a loan or approve you for a credit card, or you may pay a higher interest rate than a borrower with a good credit score.

Image: crupdatescorerange-fico-2

Image: crupdatescorerange-fico-2Will checking my scores hurt my credit?

Generally, no. Checking your own credit is generally considered a soft inquiry, meaning it won’t have a negative impact on your credit.

Even so, you’ll want to check the specific language in the terms and conditions whenever you use another service to check your credit file for your credit scores or other credit information.

What are the different credit-scoring models?

VantageScore and FICO are companies that offer different credit-scoring models. Both are widely used in lending decisions, but they differ a little in how they calculate credit scores.

VantageScore and FICO use their scoring models to turn your credit reports into credit scores for each of the three main consumer credit bureaus — Equifax, Experian and TransUnion.

What factors make up my credit scores?

There are a few factors that make up your credit scores, whether you’re looking at FICO or VantageScore scores. It’s worth briefly covering these to help you better understand your credit scores.

- Payment history — Having a history of on-time payments is most important for credit scores and gives lenders an indication of how likely you are to pay back a loan.

- Credit usage or credit utilization — Credit utilization is how much of your total credit you’re using compared to the amount you’ve borrowed. Lenders might view a higher credit utilization rate as a sign you have too much debt to pay back a new loan or credit card balance.

- Length of credit history — A longer credit history may help your credit scores by demonstrating a history of more on-time payments.

- Credit mix and types — Having a mix of different types of credit can help show lenders you have experience with different types of loans.

- Recent credit — The number of hard inquiries on your credit reports can signal to lenders that you’ve been actively seeking credit and might be a riskier borrower.

Bottom line

Whether you choose a free or paid option to monitor your Experian FICO scores, it’s a good idea to review your credit reports and credit scores regularly.

For more information on VantageScore credit scores, read our articles explaining VantageScore 3.0 and the newer VantageScore 4.0. And if you’re interested in learning how to build credit over time, check out the Credit Karma Guide to Building Credit.