In a Nutshell

Between jobs? You might qualify for unemployment insurance benefits to help you make ends meet during a difficult time. But the weekly benefit amount you’ll receive varies based on multiple factors, including which state you file in.If you’re out of work, you might be wondering, “How much does unemployment pay?”

Unemployment benefits provide temporary financial assistance for people who have lost their jobs. But the weekly benefit amount you might receive depends on the state where you filed for unemployment and how much money you made before becoming unemployed.

Let’s take a closer look at how much you might be able to get in unemployment insurance benefits.

- How much does unemployment pay?

- Who’s eligible for unemployment?

- How do I apply for unemployment?

- Hear from the experts

How much does unemployment pay?

Unemployment benefits vary by state. Generally, the amount of benefit you would receive if you qualify is based on a percentage of your total wages during a certain period of time, called the base period. States can have different base periods, but typically the term refers to four consecutive (and completed) calendar quarters.

How do you calculate how much unemployment you’ll receive?

To figure out how much unemployment pays, visit your state’s unemployment insurance website.

Your state might provide a calculator to give you a rough idea of how much you’ll receive.

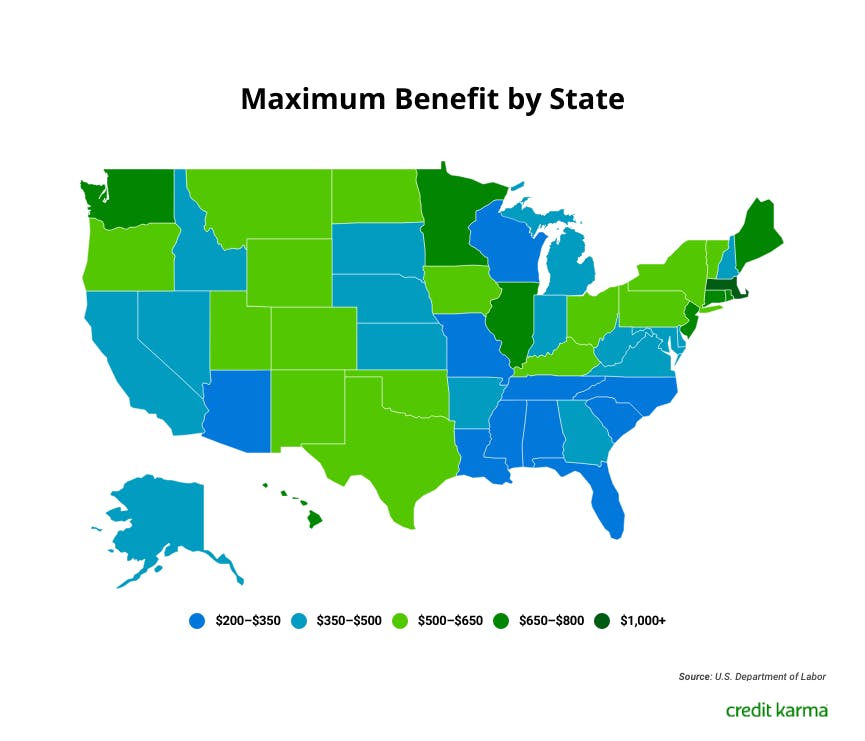

If you can’t find a calculator for your state, you might be able to estimate how much unemployment pays by figuring out what percentage of your base pay your state will match. Depending on how much money you earned before you lost your job, the weekly benefit amount you receive might be capped at the state’s maximum weekly benefit. Maximum benefit amounts vary by state, but as of January 2020, Massachusetts had the highest maximum ($1,234) and Mississippi the lowest ($235).

Keep in mind that even if you qualify for unemployment benefits, you might not qualify for the maximum benefits available in your state.

Image: corunemploypay-3

Image: corunemploypay-3How long can I receive unemployment benefits?

Typically, you can receive unemployment benefits for up to 26 weeks — or until you find another job.

But it can be extended to 39 or even 46 weeks during periods in your state when the unemployment rate is high.

Ultimately, the length of time you may claim unemployment benefits varies by state, so it’s important to check with your state for more information.

Are unemployment benefits taxable?

Unfortunately, your unemployment compensation is not tax free.

That means you’ll have to pay taxes on your unemployment benefits. You can have taxes withheld upfront from your unemployment payments, or you can report the money when you file your federal income taxes.

Before you file your tax returns, make sure you look for your 1099-G form in the mail. Like a W-2, a 1099-G reports income for the tax year — but instead of wages, the form reports certain kinds of payments issued by governments, such as unemployment.

Learn what counts as taxable incomeWho’s eligible for unemployment?

Now that you know how much unemployment pays, you might be wondering if you’re eligible.

Eligibility requirements vary by state. But generally speaking, you’ll qualify if you …

- Lost your job through no fault of your own. For example, if you were laid off, you might be eligible. But if you quit your job or were fired for misconduct, you might not qualify.

- Can demonstrate a history of work by meeting your state’s requirements for wages earned or time worked.

To learn more about eligibility requirements, check out Credit Karma’s step-by-step guide on how to file for unemployment benefits.

How do I apply for unemployment?

Thinking about applying for unemployment benefits?

If you’re ready to apply, head over to your state’s unemployment insurance website to get started. You might be asked to provide information about your previous employer and salary. So it could help to dig up your W-2 (or other tax return documents) ahead of time.

Bottom line

How much does unemployment pay? That depends on a few factors, including the state where you file your initial claim and your past wage information. You’ll need to meet eligibility requirements in order to qualify for unemployment benefits, and additional requirements to continue receiving benefits.

While the unemployment benefit you receive will generally be less than what you earned while working, it could help you stay afloat financially until you find a new job.

Hear from the experts

Q: What advice do you have for folks navigating unemployment right now?

A: One advice I would give is to think hard if your job is coming back, once the pandemic is over. We live in times when economies are very dynamic, and one needs to be flexible in meeting the demand for labor. It might not be a bad idea to learn some new tasks/skills at the local community college while being unemployed.

— Dr. Miren Ivankovic, Adjunct Professor of Economics, Clemson University

Q: How would you advise that people adjust their plans about work during the current reality?

A: The bad news is that the nature of work is rapidly changing, many industries and jobs will never be the same, and will put enormous stress on workers who will be forced to adapt. The good news is that there are more options than ever to do so. Massively Open Online Courses (MOOCs) like Coursera, edX, and Udacity offer cheap, flexible, bite-sized courses that can help supplement your current skills with those most needed as the working world evolves. Universities in general, and business schools in particular, increasingly offer high-quality, flexible, specialized degrees that can help you make a bigger transition.

— Dr. Alan Benson, Assistant Professor, Department of Work and Organizations, University of Minnesota