In a Nutshell

When you get a car loan, interest is the price you pay to borrow money from the lender. You must repay the amount you borrow plus interest in monthly payments over the life of the loan. A variety of factors, including how the interest is calculated, your credit scores, the loan term and the size of your down payment influence your rate.Interest is what you pay to borrow money from a lender when you finance the purchase of a vehicle.

Interest charges are included in your monthly loan payment and can add thousands of dollars to the amount you have to repay. That’s why it’s important to understand how car loan interest is calculated, what factors can affect your rate and how to minimize interest charges.

- How is interest calculated on a car loan?

- What’s the average interest rate on a car loan?

- Factors that can affect the interest rate on a car loan

- How can I pay less interest on my car loan?

How is interest calculated on a car loan?

Lenders calculate interest on auto loans in one of two ways — simple or precomputed. With a simple interest loan, your interest is calculated based on your loan balance on the day your car payment is due. The amount of interest you pay each month changes. On a car loan with precomputed interest, the interest is calculated at the start of your loan and based on your total loan amount. The amount of interest you pay each month remains the same. Let’s take a closer look at each type of interest.

Simple interest car loans

Most auto loans are simple interest loans, which means that the amount of interest you pay each month is based on your loan balance on the day your payment is due. If you pay more than the minimum due, the interest you owe and your loan balance can decrease.

On a simple interest loan, interest is front-loaded and amortized. With an amortized loan, part of your monthly car payment goes to the principal, which is the amount you borrowed, and part of your payment goes to the interest charges. Because the loan is front-loaded, a larger portion of each car loan payment applies to interest at the beginning of the loan term — and at the end of the term more applies to the principal balance.

For example, If you have a $25,000 car loan with a 48-month term and a 4% interest rate, you’ll pay an estimated $83 in interest and $481 in principal during the first month of the loan term. By the last month, you’ll only pay an estimated $2 in interest, and $563 will apply to the principal amount. You can use an auto loan calculator to get an estimate of your amortization schedule.

Precomputed interest

Some auto loans have precomputed interest, which means the interest is calculated upfront based on how much you’re borrowing. That amount is added to the principal and divided by the number of months in the loan term to determine your monthly payment.

Your payments don’t apply to principal and interest separately, like they do with a simple interest loan. If you pay more than the minimum due, make extra payments or pay off your loan balance early, you won’t save as much on interest as you would with a simple interest loan.

Interest rate vs. APR

There are two ways to express the cost of borrowing money from a financial institution — interest rate and APR, or annual percentage rate. An interest rate is how much you pay each year to borrow money, expressed as a percentage. APR reflects the interest rate plus any additional loan fees. It’s also expressed as a percentage. A higher APR or interest rate means that more money will come out of your pocket until you pay off the loan in full.

All lenders must disclose the APR on a loan offer. When comparing loans, pay attention to the APRs, which reflect the total financing cost. And make sure you’re comparing APR to APR, rather than APR to interest rate.

What’s the average interest rate on a car loan?

According to the Federal Reserve, in the first quarter of 2021, the average auto loan rate on a 48-month new-car loan was 5.21%, and the average rate on a 60-month new-car loan was 4.96%.

A range of factors can affect what interest rates you might be offered, including your credit scores, the size of your down payment and the length of your loan term. Your rate may be higher or lower than average depending on your financial situation.

Factors that can affect the interest rate on a car loan

Your lender determines your interest rate after a review of your credit and finances. These are just some of the factors that may affect the rate you’re offered.

Credit scores

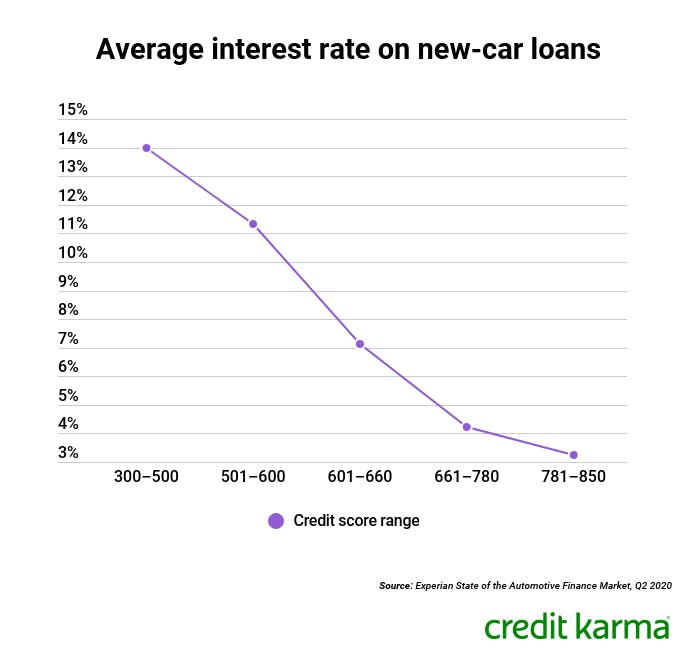

In general, people with good credit scores are more likely to qualify for lower rates than people with lower scores. Average interest rates on new-car loans for people with the highest credit scores were nearly 11 percentage points lower than for people who had the lowest scores, according to Experian’s State of the Automotive Finance Market report for the first quarter of 2020.

Image: aarefreshinterest1-2

Image: aarefreshinterest1-2Type of lender

Many banks, credit unions and online lenders offer auto loans. But credit union car loans typically have lower interest rates than car loans from banks.

Image: aarefreshinterest2-2

Image: aarefreshinterest2-2Automakers’ finance companies also offer auto loans, and they may run special promotions. If you have excellent credit, you may be able to snag a 0% APR offer from the dealer.

Loan term length

Lenders may charge higher interest rates on loans with longer terms. And since cars depreciate quickly, you could end up owing more than your car is worth if you choose a longer loan term. It may be tempting to choose a longer term to reduce your monthly loan payment, but you could end up paying more in interest over the length of the loan than if you chose a shorter term.

Down payment

Lenders may charge higher rates when you put little or no money down. This higher rate is in exchange for the risk that you’ll default on the auto loan and the lender will be left with a vehicle that’s worth less than you owe.

New vs. used

Rates on new-car loans tend to be lower than rates on used-car loans. The average interest rate on a used car loan was 9.65% in the first quarter of 2020, compared to 5.61% on a new-car loan, according to Experian’s State of the Automotive Finance Market report.

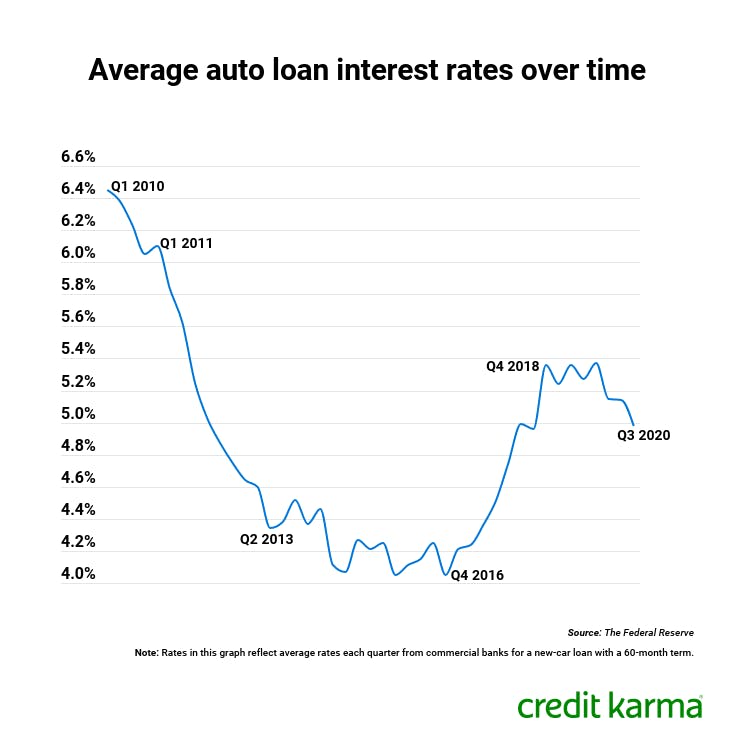

Interest rate environment

Interest rates aren’t static. They move up and down based on market conditions. When times are tough — like during the financial crisis of 2007 to 2009 — rates tend to be lower to encourage people to borrow money and businesses to invest in expanding. When the economy is strong, rates are typically higher to help slow inflation.

Image: aarefreshinterest3-2

Image: aarefreshinterest3-2Be sure to check rates before you begin car shopping. Some lenders post their starting APRs on their websites.

How can I pay less interest on my car loan?

Interest charges can add thousands of dollars to the amount you have to repay. But there are ways you may be able to minimize the impact on your wallet if you need to finance your car purchase.

- 0% APR financing — If you have excellent credit and the auto manufacturer’s finance division offers special financing, you may be able to take advantage of 0% APR financing for a certain amount of time.

- Early repayment — If you have a simple interest loan, you can reduce your interest charges by paying more than the minimum due each month or paying off the balance early.

- Shorter loan term — Choosing a shorter repayment term will lower the total amount of interest you pay in the long run. But it’ll increase your monthly payments, so be sure you can afford it.

- Refinance down the road — If interest rates drop or your credit improves after you get your car loan, you may be able to get a lower rate by refinancing your auto loan.

Next steps

If you need to get a car loan to finance a vehicle purchase, check out online calculators to see how different rates could affect your monthly payment and the total cost of your loan.

Don’t forget to shop around and compare loan offers from multiple lenders. Remember that your interest rate is just one part of your loan — be sure you understand all the terms of a car loan so you can compare offers and get the best deal for you.