In a Nutshell

Some states have no-fault auto insurance laws in place. In these states, drivers must file a claim with their insurance company after an accident, no matter who was at fault, and may be restricted in their ability to sue the other driver. If you live in a no-fault state, you’ll be required to buy personal injury protection in addition to any other types of coverage your state requires.Car insurance is mandatory in almost every state, but the laws governing it vary based on where you live.

In no-fault states, drivers must file claims with their own insurance companies, regardless of who caused the accident. And they likely won’t be able to sue the other driver unless their medical condition or expenses meet a certain threshold.

In this article, we’ll look at how no-fault car insurance works, which states have no-fault laws in place and the types of coverage required in these states.

- What does it mean to be a no-fault state?

- What insurance is typically required in a no-fault state?

- Which states have no-fault insurance laws?

What does it mean to be a no-fault state?

Car insurance laws can be defined as no-fault, choice no-fault, add-on or tort liability.

In states with no-fault laws, each driver files a claim with their own insurance company following an accident, regardless of who is at fault.

No-fault insurance laws also affect a person’s ability to sue if they’re injured in a car crash. In no-fault states, drivers may be able to sue only if their injuries or medical expenses meet a specific verbal or monetary threshold. In states with a verbal threshold, an injury must be of a certain severity that’s expressed in verbal terms (for example, disfigurement). In states with a monetary threshold, medical bills must reach a certain dollar amount before someone can sue the other driver.

Some states have a type of no-fault law called choice no-fault law. Drivers in these states can choose between no-fault car insurance coverage and a traditional tort liability policy.

How are no-fault states different from tort liability states?

In tort liability states, someone who’s injured in an accident they didn’t cause will file a claim with the at-fault driver’s insurance company rather than their own insurer. The injured person can also sue the at-fault driver for any pain and suffering or out-of-pocket medical costs — there are no restrictions on someone’s right to sue after an accident.

How do add-on states work?

Add-on states essentially have a mix of no-fault and tort liability laws. Like no-fault states, states with add-on laws require drivers to file claims with their own insurance providers after a car accident. But similar to tort liability states, add-on states place no restrictions on a driver’s ability to file a lawsuit to seek compensation for injuries after a car accident.

What insurance is typically required in a no-fault state?

No-fault states may require some of the same types of coverage that tort liability states require, with one exception: personal injury protection, or PIP.

In true no-fault states, drivers are required to carry PIP. PIP coverage may also be mandatory in states with add-on insurance laws. PIP coverage can help foot the bill for your or your passengers’ medical costs after an accident. It may also help cover accident-related costs such as lost wages and funeral expenses.

In addition to PIP, you may be required to buy these types of coverage.

Liability insurance

Bodily injury liability and property damage liability insurance are required in almost all states. The only two exceptions are New Hampshire and Virginia. This coverage is optional in New Hampshire — but if you choose to forego liability insurance, you’ll have to show proof that you could provide sufficient funds to cover expenses if you caused an accident. In Virginia, you can pass on liability coverage if you pay an annual fee to the state’s department of motor vehicles.

In some no-fault states, residual bodily injury liability coverage can help protect you if you’re sued after causing an accident that results in injuries that meet a certain threshold, as defined by your state. Property damage liability insurance can help pay for any damage you cause to another person’s car or property as a result of a collision.

Uninsured and underinsured motorist coverage

Uninsured and underinsured motorist coverage may help pay for injuries caused by a hit-and-run driver or someone who doesn’t have the minimum required liability insurance — or any insurance at all. This type of coverage may kick in if you’ve exhausted your PIP benefits and the other driver doesn’t have enough bodily injury liability coverage to cover your medical claims.

Uninsured and underinsured motorist coverage are required in some states. Check out this chart created by the Insurance Information Institute to see if your state might require uninsured and/or underinsured motorist coverage.

Required by some lenders: Comprehensive and collision coverage

While comprehensive and collision coverage aren’t mandated by law, if you lease or finance your car, the leasing company or lender may require you to purchase these types of insurance. This coverage protects their investment in the vehicle in the event of an accident.

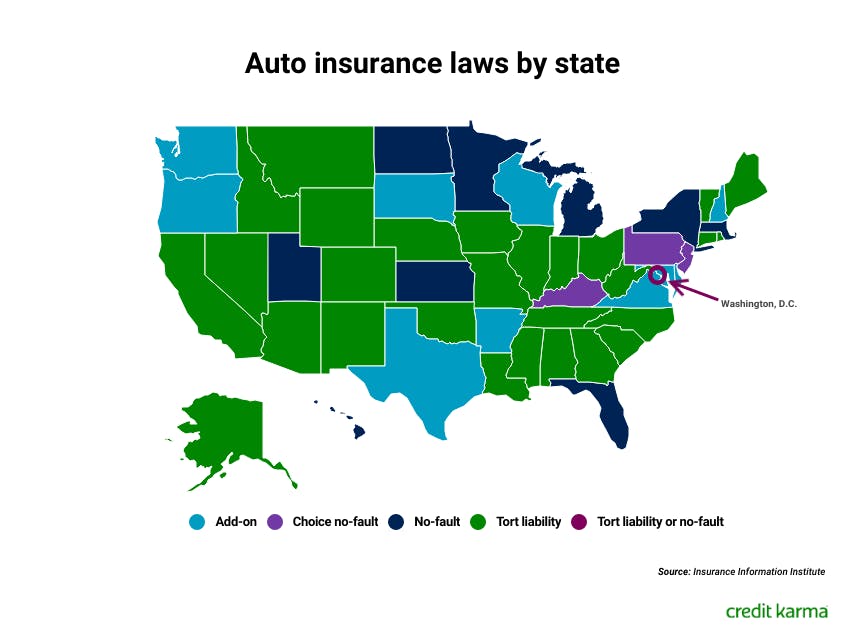

Which states have no-fault insurance laws?

Image: aanofault

Image: aanofaultThe following states and territories have no-fault insurance laws:

- Florida

- Hawaii

- Kansas

- Massachusetts

- Michigan

- Minnesota

- New York

- North Dakota

- Puerto Rico

- Utah

Three states have choice no-fault insurance laws:

- Kentucky

- New Jersey

- Pennsylvania

The following states have add-on insurance laws:

- Arkansas

- Delaware

- Maryland

- New Hampshire

- Oregon

- South Dakota

- Texas

- Virginia

- Washington

- Wisconsin

In the District of Columbia, drivers can choose between tort and no-fault coverage. In the event of an auto accident, someone who previously chose no-fault coverage has a 60-day window to decide whether to stick with no-fault benefits or file a claim against the at-fault driver.

What’s next?

If you’re shopping for car insurance for the first time or you’ve just moved to a new state, be sure to find out whether your state has no-fault insurance laws and which coverage is mandatory. From there, you can shop around and compare car insurance quotes from multiple insurers to help find an insurance policy that might better fit your needs and budget.

If you live in a no-fault state and have been in a car accident, check with your state’s transportation agency to understand your state’s no-fault laws, including any restrictions on your ability to sue.