In a Nutshell

Most new credit cards come with an EMV chip, but what's it for? The now-ubiquitous credit card chip cuts down on fraud — and it may change how you make everyday purchases.What is a credit card chip?

A big change happened to credit cards back in October 2015. U.S. consumers joined their Canadian and European counterparts in switching from “swipe-and-sign” cards to “chip-and-signature” cards equipped with EMV chips.

This change included the EMV liability shift. This transferred the liability for counterfeit fraudulent transactions from the issuer to the merchant if the card has an EMV chip and the merchant doesn’t support EMV chip transactions. Since then, merchants have had a real incentive to support EMV chip technology.

These cards can be identified by the small silver- or gold-colored EMV chip embedded on the card’s face (you’ll usually find it on the left, just above the numbers).

Chances are, you won’t need to look hard to find one — and you probably already have one in your wallet.

- What does EMV mean?

- Why does having a credit card chip matter to you?

- Chip-and-signature vs. chip-and-PIN: What’s the difference?

- EMV chip security explained

- Other ways to protect yourself from credit card fraud

What does EMV mean?

EMV is an acronym for Europay, Mastercard and Visa. The EMV chip is the global standard used for credit card chips worldwide, and most card-present transactions in Europe, Canada, Latin America, Africa and the Middle East are now EMV.

Why does having a credit card chip matter to you?

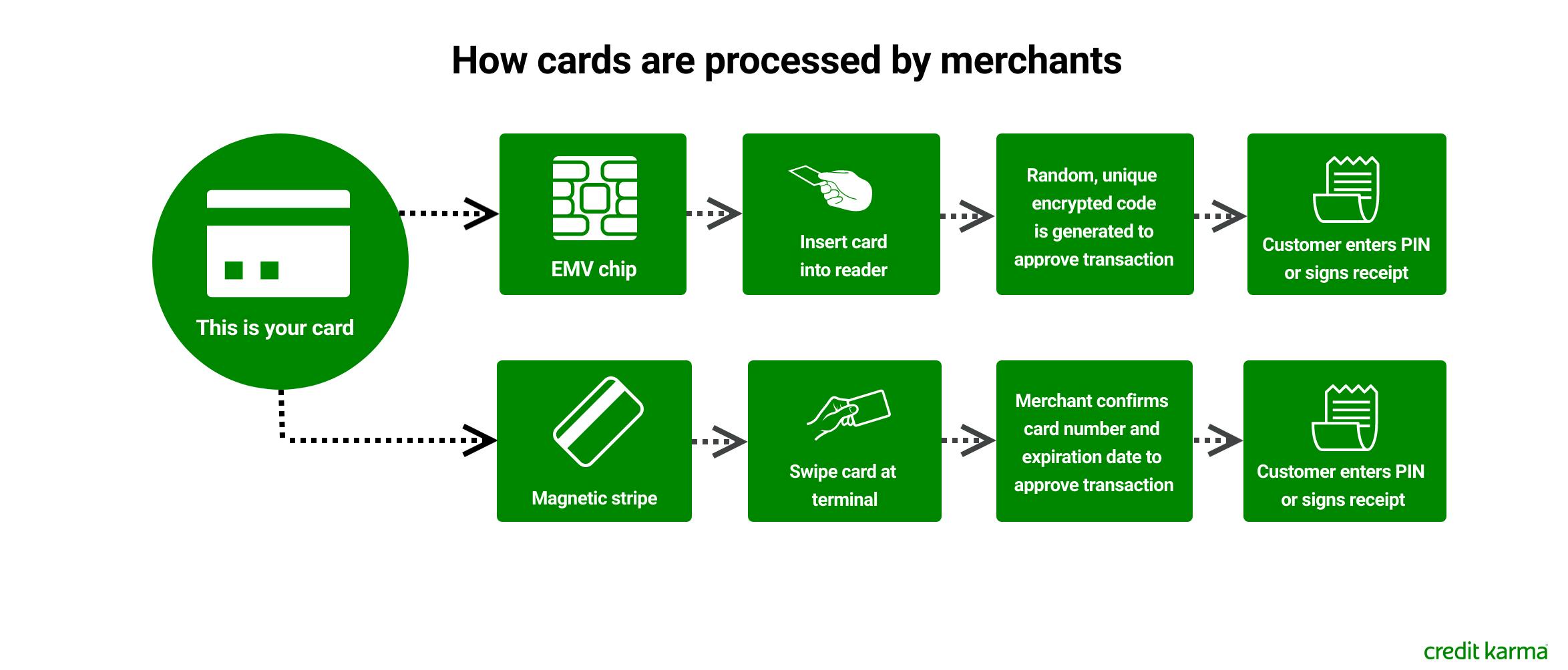

In a practical sense, having an EMV chip on your credit card changes how you make purchases. As you’ve probably already experienced, merchants now generally ask that you insert your card into a chip reader rather than swipe the magnetic strip on the back of the card.

But the EMV chip means a lot more than a different way of paying. The chip’s processing method makes your transactions more secure and may help to reduce credit card fraud. More on that later, but let’s first talk about the different types of chip cards you might encounter.

Chip-and-signature vs. chip-and-PIN: What’s the difference?

Chip cards currently come in two different forms in the U.S. Most cards are considered chip-and-signature cards. After you insert your card in a chip reader, you may be asked to sign for your purchase.

The other type of chip card is a chip-and-PIN card. These cards ask you to enter a PIN (personal identification number) to complete your purchase. When PIN entry is not supported by a merchant, you may be asked to sign for the purchase.

In the past, it was very important to have a chip-and-PIN card when traveling in Europe and other overseas locations. This is because you needed a PIN to complete transactions at unmanned kiosks, such as those at train stations. But this is not as a widespread a problem as it used to be, since many kiosks will now let you bypass the PIN prompt.

Without a chip-and-PIN card, there still may be some instances where you have to use local currency or find a cashier to complete your transaction. If you’re a frequent traveler, you might need a chip-and-PIN card at some point.

Are chip-and-signature cards as safe as chip-and-PIN cards?

Chip-and-signature cards are considered less secure because they rely on merchants to verify that your signature matches the one on the back of your card. Chip-and-PIN cards are harder to use fraudulently, since criminals must know your PIN to complete a transaction. But even without requiring a PIN, chip-based cards are said to be more secure than credit cards without a chip.

EMV chip security explained

Image: ccupdateemv

Image: ccupdateemvMagnetic swipe cards pose a considerable security risk.

Because the same limited set of numbers authenticate every transaction, it’s easier for thieves to steal those numbers and make counterfeit cards with that stolen data.

On the other hand, because a unique code is created for each credit card transaction, EMV chip cards provide more security than the magnetic stripe and signature cards. This randomized one-time code is encrypted and extremely difficult for criminals to duplicate without expensive equipment.

Other ways to protect yourself from credit card fraud

Protecting yourself from credit card fraud requires vigilance. Make sure to keep an eye on your credit card statements and credit reports.

Immediately report any purchases you don’t recognize and follow up to make sure you aren’t on the hook for any fraudulent transactions.

You’ll want to make sure you protect your credit card number, too. Scammers often try to fool unsuspecting consumers by creating official-looking emails that ask for credit card details, so always double-check the source before clicking on a link or replying to an email with sensitive personal information.

Bottom line

Credit card security continues to improve, and EMV chips account for a significant part of that improvement. Still, it’s important to note that you’re never completely safe from risk. While in-person transactions with a chip card are generally safer, criminals may turn to more vulnerable card-not-present transactions, such as internet or telephone purchases, to continue to scam consumers.

In the unlucky case that you’re the victim of fraud, your liability for credit card fraud is limited to $50 under the Fair Credit Billing Act. That’s good news, but the feeling that comes with someone violating your credit and personal information may be harder to get over than a $50 loss.

The moral of the story? Keep an eye out for fraud when reviewing your credit card statements, and report anything that looks a little fishy.