Getting rewarded for everyday purchases can be one of the most exciting benefits of using credit cards. And with the right activity, they can help you improve your credit scores and level up to another class of credit card.

Many rewards cards also come with free tools to help monitor and boost your credit scores, like automatic reviews for credit line increases or APR decreases after consistent good credit behavior.

We’ve highlighted some of our favorite cards that can help you start earning rewards and get access to credit building features right away.

- Capital One QuicksilverOne Cash Rewards Credit Card: Get cash back with fair credit

- Citi Double Cash® Card: Earn more cash back on all purchases

- Discover it® Secured Credit Card: Get rewards with the potential to upgrade

- Capital One VentureOne Rewards Credit Card: Earn travel rewards

Capital One QuicksilverOne Cash Rewards Credit Card: Get cash back with fair credit

The Capital One QuicksilverOne Cash Rewards Credit Card can be an excellent option for those with fair credit who are looking to earn cash back on all purchases.

This card offers unlimited 1.5% cash back on every purchase, making it simple to earn rewards without worrying about rotating categories or spending limits. With a $39 annual fee, you’d need to spend a few hundred dollars every month to recover that upfront cost.

The Capital One QuicksilverOne Cash Rewards Credit Card also features automatic reviews for credit line increases after as little as six months. With a higher credit line, it might be easier to maintain a lower credit card utilization rate and raise your scores.

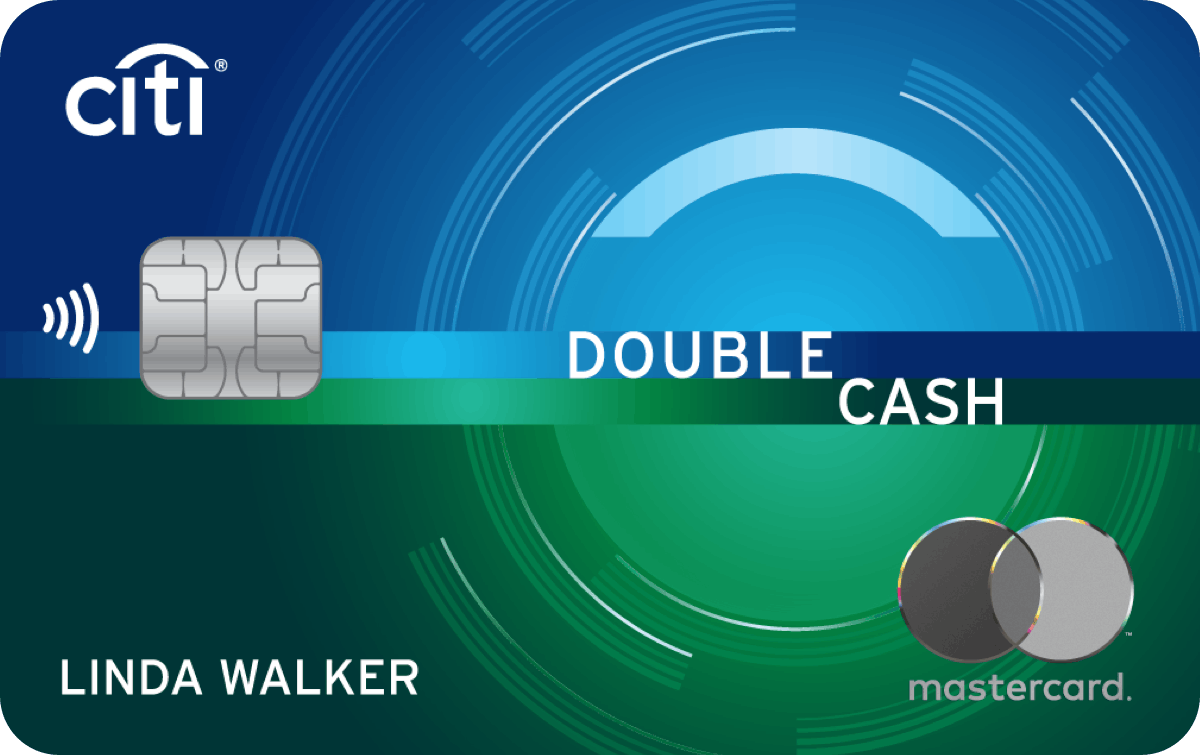

Citi Double Cash® Card: Earn more cash back on all purchases

The Citi Double Cash® Card is another strong option for those looking to earn rewards on all purchases. This card comes with a $0 annual fee and offers an impressive 2% cash back on all purchases — 1% when you buy and another 1% when you pay.

You’ll also get a sign-up bonus worth $200 when you spend $1,500 on purchases in the first 6 months after your account opens.

The Citi Double Cash® Card also features a 0% introductory APR for 18 months on balance transfers (then 18.24% - 28.24%) completed within the first four months of account opening. You’ll also pay a balance transfer fee: Intro fee 3% of each transfer ($5 minimum) completed within the first 4 months of account opening. After that, 5% of each transfer ($5 minimum). This offer might allow you to pay down an existing credit card balance quicker by paying less interest over time, which could help you raise your scores.

Discover it® Secured Credit Card: Get rewards with the potential to upgrade

The Discover it® Secured Credit Card is the only card on our list that requires a deposit, but it’s one of the rare secured cards that offers cash back, a $0 annual fee and a clear opportunity to graduate to an unsecured card.

For rewards, you’ll get 2% cash back at gas stations and restaurants (on up to $1,000 in combined purchases each quarter) and 1% cash back on all other purchases.

The Discover it® Secured Credit Card requires a security deposit of a minimum $200, and that deposit will also set your credit line. Not everyone can afford that deposit, but you can get it back and upgrade to an unsecured card after a minimum of six consecutive on-time payments (while also maintaining good status on all your credit accounts).

That mix of rewards and extra motivation to pay on time could make this card a good choice to help you improve your credit, even if a secured card isn’t your first choice.

Capital One VentureOne Rewards Credit Card: Earn travel rewards

The only travel rewards card on this list, the Capital One VentureOne Rewards Credit Card offers 1.25 miles per $1 spent on every purchase. Your rewards can be redeemed for travel expenses such as flights, hotels and car rentals through Capital One’s travel portal. Plus, there’s a $0 annual fee, making it an affordable option for those looking to earn travel rewards.

On top of it all, you’ll also get 20,000 bonus miles when you spend at least $500 on purchases within the first 3 months of account opening.

The Capital One VentureOne Rewards Credit Card also provides access to CreditWise, which allows you to monitor your credit score and track your progress. It includes a credit simulator, which allows you to choose “what if” actions regarding your financial situation to see how certain decisions may affect your credit score.

Finding more rewards cards that can help you build credit

The cards on this list all offer rewards alongside features that set you up for success with your credit. While you need to pay on time and not use too much of your credit line to improve your scores, these cards help make that easier with more manageable fees and other features that can help motivate you to stay on top of your credit.

But it’s important to remember that this list is just a place to start. Not everyone will qualify for every option on this list, and other cards might feature rewards categories or other perks you prefer. The key is to find the right option for you, both in terms of card features and your chances at approval.

As you look for your next card, keep an eye out for the same things we pointed out here — strong rewards, low fees and additional features that can help you manage debt and improve your credit.