In a Nutshell

VantageScore 3.0 offers more consistency to the credit scoring model and makes credit scores available to consumers with little credit history.Most people associate credit scores with FICO, and with good reason. And while there are many credit scoring models out there, the other main scoring model is VantageScore®.

The Fair Isaac Corporation (formerly Fair, Isaac and Company) introduced the first general-purpose credit score in 1989, and FICO® credit scores have been used in a wide range of lending decisions ever since. But FICO® scores aren’t the only credit scores you’ll see. The other main scoring model is VantageScore®, the third version of which — VantageScore 3.0 — is widely used today.

- What is VantageScore 3.0?

- At a glance: VantageScore 3.0 vs. other scoring models

- How is your VantageScore 3.0 calculated?

- How does VantageScore 3.0 compare to FICO models?

- What is the difference between VantageScore 3.0 and VantageScore 4.0?

What is VantageScore 3.0?

As we mentioned, VantageScore 3.0 is the third version of the alternative credit score model to FICO. But to fully understand how the scoring model works, let’s take a quick step back.

It all started in 2006, when the three major consumer credit reporting bureaus — Experian, TransUnion and Equifax — teamed up to create the first iteration of the VantageScore® credit scoring model.

VantageScore went through several versions before VantageScore 3.0 debuted in 2013. The new model became so successful that approximately 40 million Americans who had previously been without a credit score are now able to get one, according to VantageScore.

The fourth and latest version of the VantageScore® model, VantageScore 4.0, debuted in 2017, but many lenders continue to rely on VantageScore 3.0.

With that in mind, let’s review some of the basic information you should know about how VantageScore 3.0 works and how it differs from other credit scoring models.

At a glance: VantageScore 3.0 vs. other scoring models

Credit factor | VantageScore 3.0 | VantageScore 4.0 | FICO® Score 8 | FICO® Score 9 |

|---|---|---|---|---|

| Utilization rate | Very important | Very important | Very important | Very important |

| Historical utilization rate and payment info (trended data) | No impact | May affect your score | No impact | No impact |

| Collection accounts | Ignores paid collection accounts | Ignores paid collection accounts

Ignores medical collection accounts that are less than six months old Weighs unpaid medical collection accounts less than other types of collection accounts | Ignores small-dollar “nuisance” accounts that had an original balance of less than $100

Treats medical collection accounts, including those with a zero balance, like other collection accounts | Ignores paid collection accounts

Weighs unpaid medical collections less than other types of collection accounts |

| A tax lien or judgment | Can have a significant impact | Are less important than before, but can still have a significant impact | Can have a significant impact | Can have a significant impact |

How is your VantageScore 3.0 calculated?

VantageScore 3.0 credit scores range from 300 to 850. Earlier iterations of the VantageScore® model featured a different range, but VantageScore 3.0 adopted the 300 to 850 range — the same range as most FICO® scores — to make it easier for lenders to use.

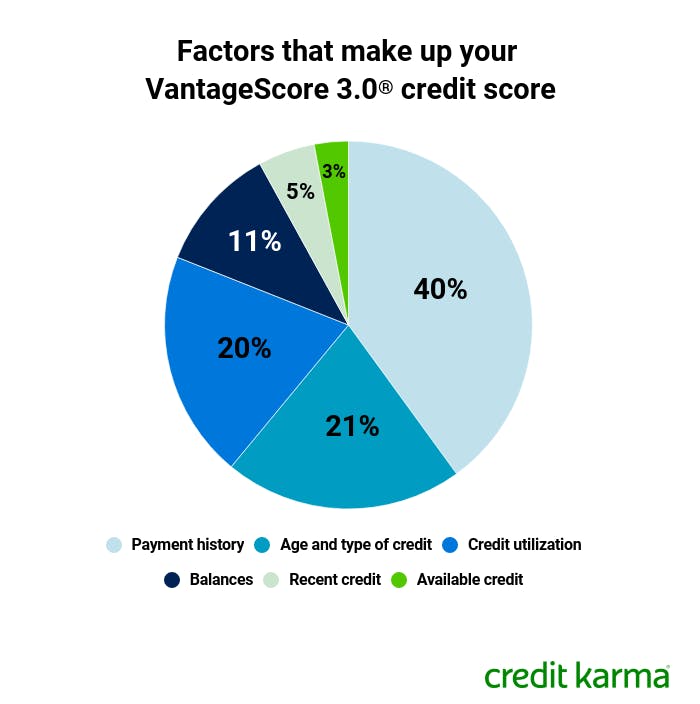

Though individual credit scores are based on a complex series of calculations, VantageScore does offer some insight into how the various credit factors are used to calculate a VantageScore 3.0 score.

Generally, here’s how the categories can break down.

Image: ccupdateutilization-vantage-2

Image: ccupdateutilization-vantage-2Payment history (about 40%)

The biggest factor in your VantageScore 3.0 credit scores is payment history. In other words, are you consistently paying your bills on time, or are you frequently delinquent on your accounts?

Payment history is typically represented as a percentage showing how often you’ve made on-time payments. Given the weight of this factor, late or missed payments have the potential to significantly harm your credit scores.

Age and type of credit (about 21%)

VantageScore 3.0 also factors in how long you’ve had different types of credit accounts open. (Don’t worry — it doesn’t refer to your actual age.)

Ideally, lenders like to see long-term, established lines of credit. Having a variety of account types is a bonus — as long as you stay up-to-date on your payments — as lenders also typically like to see that you’ve used a mix of accounts on your credit responsibly.

Credit utilization (about 20%)

Credit scores are intended to help lenders get a clearer picture of the type of borrower you might be. That’s why they want to see you using a small percentage of your available credit at any given time. Experts generally recommend a credit utilization ratio of below 30%.

Balances (about 11%)

This factor refers to the total amount of recently reported balances (current and delinquent) on your credit accounts.

Lenders generally like to see low balances on your other credit accounts, as it suggests the chances of you making on-time payments each month is higher. Though the best method is to pay off your balances monthly.

Recent credit (about 5%)

Have you applied for a new credit card lately? Maybe taken out a personal loan? Lenders may want to know these types of things, as your recent credit activity, including recently opened credit accounts and credit inquiries, can be an indicator of future financial performance.

Available credit (about 3%)

Although not a huge factor, lenders typically like to see that you’re only taking out the credit that you need.

How does VantageScore 3.0 compare to FICO® models?

There are many similarities between the VantageScore® and FICO® credit-scoring models. Not only are both typically calculated on a 300-to-850-point scale (newer FICO® scores may range up to 950), but both models put a lot of emphasis on payment history and credit utilization.

For the sake of comparison, let’s take a look at how FICO weighs various factors in your credit scores. Some of these factors may have slightly different names from what we referenced above, but they refer to similar information in your credit reports.

Image: ccupdateutilization-fico-3

Image: ccupdateutilization-fico-3- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- New credit: 10%

- Other factors, such as types of credit used: 10%

While much of the information is comparable, one big difference may lie in how VantageScore and FICO evaluate data in order to generate scores, particularly for people without much credit history.

If you have little credit history, there’s a good chance you might not have a FICO® score. FICO requires at least six months of account data reported to a credit bureau within the past six months before a score can be established.

VantageScore, on the other hand, might be able to provide more people with a credit score by using just one month of history on at least one account reported within the previous 24 months.

Do you have a collection account on your credit reports? VantageScore may be a little more forgiving to your situation. Unlike the FICO® 8 credit scoring model, VantageScore 3.0 will ignore any collections account that has been paid in full. (FICO® 9 also ignores any collection account that is paid in full.)

What is the difference between VantageScore 3.0 and VantageScore 4.0?

Over time, VantageScore Solutions has adjusted its credit scoring model to better reflect consumers’ overall credit profile.

In 2017, VantageScore announced a new version of its credit scoring model: VantageScore 4.0. This new model introduces several changes that could affect your credit scores.

Here’s a summary of some of the important changes VantageScore 4.0 brings to the table.

Trended credit data

Typically, credit scores have only been able to take a snapshot of your credit reports based on how they look at a specific period of time. VantageScore Solutions claims that VantageScore 4.0 is the first and only credit scoring model to use trended data from the three major consumer credit reporting bureaus — meaning it could offer deeper, more-accurate insight into your borrowing and payment patterns.

Jeff Richardson, vice president of marketing and communications with VantageScore® Solutions, offers an example: A consumer might accumulate debt around the holidays and then purchase a new car in January. In the short term, that consumer might look like a high-risk borrower. However, going back over a longer historical period, as VantageScore 4.0 purports to do, might tell a different story. The end result could be a clearer picture of the borrower.

Tax liens, judgments and medical collection accounts might not hurt as much

In July 2017, TransUnion, Experian and Equifax adopted stricter requirements for collecting and reporting consumers’ tax liens and civil judgments. In light of that change, VantageScore 4.0 doesn’t rely as heavily on tax liens and civil judgments as some previous scoring models.

Credit scores for more consumers

VantageScore 4.0 could be welcomed by consumers with a thin or dormant credit history. VantageScore Solutions says the model leverages “machine learning techniques” to better develop scorecards for consumers with no update to their credit files in the previous six months.

The firm believes this will bolster VantageScore’s ability to accurately score 30–35 million consumers neglected by traditional scoring models.

What’s next

When it debuted in 2013, VantageScore 3.0 added a new dimension to the credit scoring model. Its successor, VantageScore 4.0, similarly aims to provide lenders a better picture of consumers’ credit.

Richardson explains that with each evolution of its scoring model, VantageScore Solutions aims to bring three key items to the market: greater accuracy, greater reach and more consistency.

Credit scores are an ever-evolving concept, but knowing how different models incorporate credit factors can help you address any issues that may arise.