In a Nutshell

Deciding whether to use a 401(k) to pay down debt depends on your financial position. Early withdrawal from your 401(k) can cost you in taxes and fees and isn’t often recommended unless absolutely necessary.Paying off debt can feel like a never-ending process.

With many debt repayment strategies, tactics and tools available — from balance transfer cards to debt consolidation loans — it may be hard to determine which is the right solution for you. One option you may consider is using your 401(k) to pay off debt. But keep in mind that cashing out your 401(k) early can cost you in penalties, taxes and potential financial gains. While many people try to avoid it, there are some circumstances where it may be a good option.

- Can you borrow from your 401(k)?

- How to decide whether you should cash out your 401(k)

- What are the pros and cons of using your 401(k) to pay off debt?

- Ways to pay off debt without cashing out your 401(k)

- FAQs about using a 401(k) to pay off debt

Can you borrow from your 401(k)?

First, let’s establish how you can use a 401(k) retirement plan before you actually reach retirement. There are two approaches available to you: a 401(k) withdrawal or a 401(k) loan.

401(k) withdrawal rules

With some exceptions for qualifying hardships and specific circumstances, early distributions from your 401(k) plan are subject to both:

- Automatic 20% federal tax withheld in most instances

- Additional 10% tax (also considered an early withdrawal penalty)

Even if your specific need or circumstance is considered a qualifying exception, standard income tax rates will still apply to your withdrawal.

An additional downside to a 401(k) withdrawal is that once the money is deducted from your account, it’s gone for good. You may also lose out on the long-term benefits of compound interest, which is earned based on a combination of your principal balance plus any accumulated interest from past periods.

Once you reach the age of 59½, you can make withdrawals without the early withdrawal penalty, but you will still have to pay income tax on your withdrawals.

401(k) loan

A 401(k) loan differs from a 401(k) withdrawal because money borrowed from the retirement plan must eventually be repaid. Keep in mind that not all plans permit 401(k) loans.

A 401(k) loan can help you take advantage of some of your retirement savings early and tax-free. The benefit of borrowing against your retirement, rather than, say, securing a personal loan, is that any interest you pay is paid back to your plan instead of paying interest to a bank.

Typically, a retirement plan allows you to borrow either:

- Up to 50% of the plan’s value

- Up to $50,000 (whichever is the lesser of the two)

Keep in mind that 401(k) loans must be repaid within five years unless you use the proceeds to buy a primary home. Be sure to check your plan’s fine print carefully before deciding whether borrowing against your 401(k) is a good choice for you.

How to decide whether you should cash out your 401(k)

Is it a bad idea to withdraw from a 401(k) to pay off debt? The short answer: It depends.

If debt causes daily stress, you may consider drastic debt payoff plans. Knowing that early withdrawal from your 401(k) could cost you in extra taxes and fees, it’s important to assess your financial situation and run some calculations first.

Here’s how to do that.

Image: how-to-decide-whether-you-should-cash-out-your-retirement

Image: how-to-decide-whether-you-should-cash-out-your-retirement1. Check your eligibility

Keep in mind that if you do withdraw money from your 401(k) early, you’ll likely incur a penalty. (There are some reasons that fall under the government’s list of exceptions.)

For instance, your 401(k) may allow you to withdraw money early for “an immediate and heavy financial need.”

These hardship withdrawals may include scenarios such as medical expenses, postsecondary educational fees, bills to prevent foreclosure or eviction, funeral expenses or home repairs for a primary residence.

The withdrawal cannot be more than the amount of financial assistance required to satisfy the need. You’ll also have to show that you don’t have other resources readily available that could satisfy the financial need.

If you want to consider a 401(k) loan, keep in mind that not all plans offer these. To see what you may be eligible for, look up your 401(k) documentation or contact a trusted financial advisor.

2. Assess your current financial situation

Once you understand if you’re eligible, assess your financial picture. How much debt do you have? Try a budget calculator to see if you’re able to allocate different funds toward what you owe.

For example, if you have $2,500 in credit card debt and a steady source of income, you may be able to pay off debt by adjusting your existing habits. Cutting the cord with your TV, cable or streaming services could be a great money saver.

However, if you’re on the verge of a financial crisis, living on a tight budget may not be enough. That’s when using your 401(k) may be an option worth considering.

3. Calculate how much of your retirement may be at risk

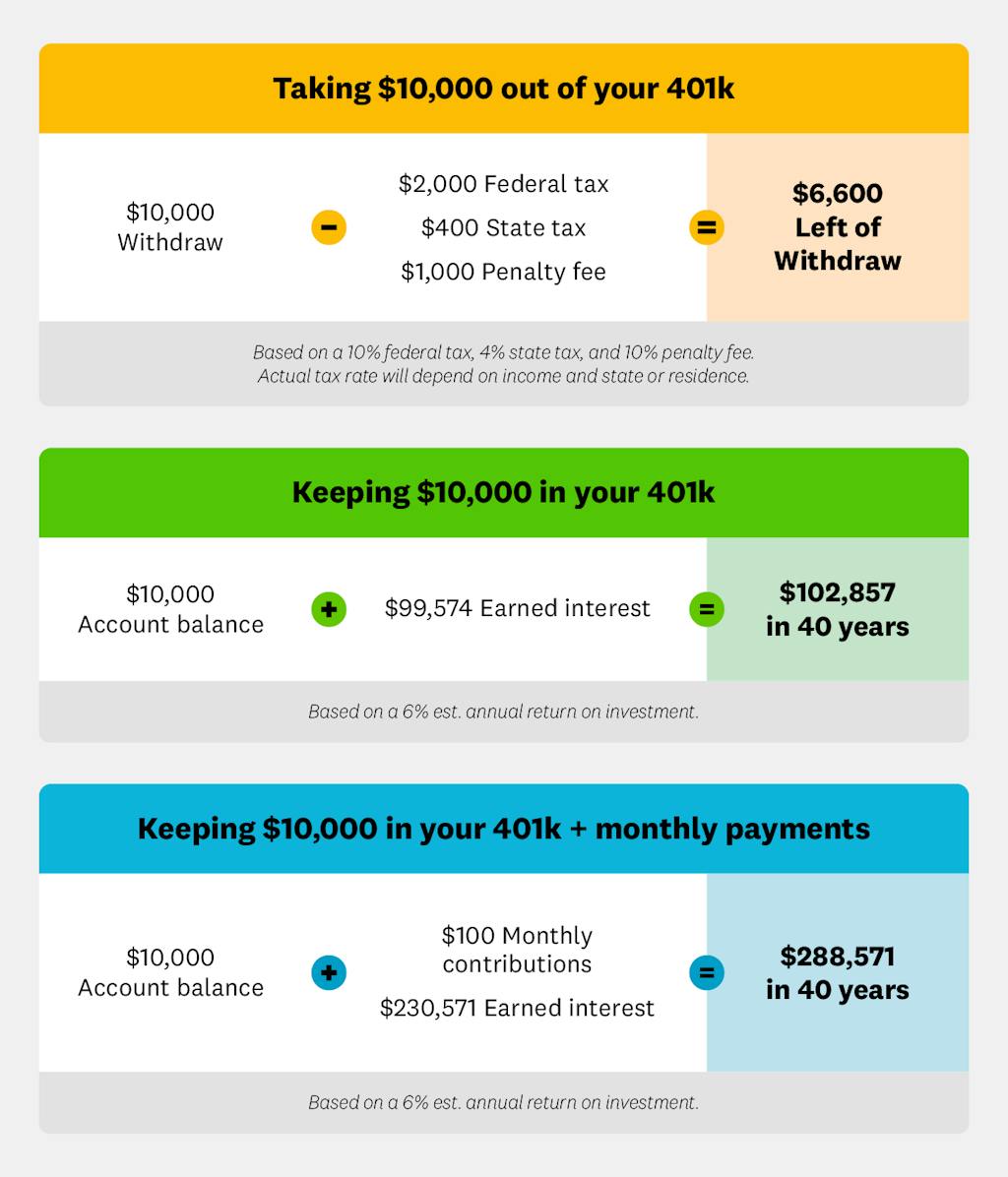

Setting up a retirement plan is intended to benefit your financial future, and the government tries to reinforce that for your best interest. When you withdraw your earnings early, you may have to pay taxes and penalties on the amount you withdraw. Your tax rates will depend on federal income and state taxes where you reside.

For example, say you’re in your mid-20s and you have 40 years until you’d like to retire. You decide to take out $10,000 to put toward your student loans. Assuming the 20% automatic federal withholding and a state tax of 4%, with a 10% penalty fee, you would receive $6,600 of your $10,000 withdrawal. The additional $3,400 expense would be withheld.

You’ll also have less money left over for potential investment gains in the future.

The bottom line: No matter how much you withdraw early from your 401(k), you will face significant fees. These fees may include federal taxes, state taxes and penalty fees.

What are the pros and cons of using your 401(k) to pay off debt?

Image: Pros-and-Cons-401K-debt

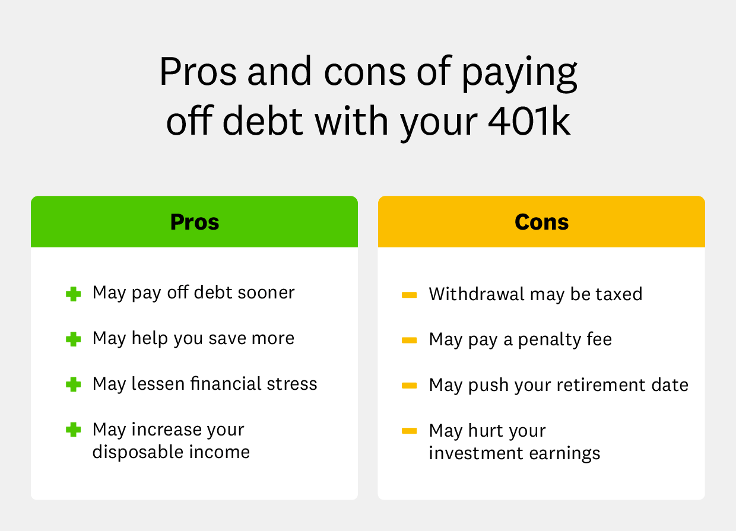

Image: Pros-and-Cons-401K-debtBefore withdrawing money from your 401(k), there are some pros and cons to consider.

Pros

- May pay off debt sooner: In some cases, you may pay off debt earlier than you expected. By putting your 401(k) withdrawal toward your existing debt, you may be able to pay off your account in full. This can help you save in the long run by eliminating future monthly interest payments.

- May save more money: If you’re able to pay off your debt with your early withdrawal, you may find more wiggle room in your monthly budget. If you have extra money each month, you could contribute more to your savings. Think about putting your money in a high-yield savings account.

- May have less financial stress: Debt may cause you daily stress. By increasing your debt payments with a 401(k) withdrawal or loan, you may save yourself mental energy.

- May have higher disposable income: If you can pay off your debts, you may have more financial freedom. With this flexibility, you may be able to save for a house or reach another financial goal.

Cons

- May have a higher tax bill: You may have to pay a hefty tax payment for your early withdrawal. Your 401(k) is taxed as ordinary income when it’s paid out. Your federal and state taxes are determined by where you reside and your yearly income.

- May pay a penalty fee: To discourage you from cashing out your 401(k), there’s a 10% penalty that will be withheld from your distribution.

- May cut your investment earnings: You may earn investment returns on money in your 401(k). When you withdraw money, you’ll likely earn a lower amount of over time since your base amount is lower.

- May push your retirement date: Taking money out of your 401(k) may harm your future financial goals. With less money in your retirement fund, you may lower your retirement income. Doing so could push back your desired retirement date.

5 ways to pay off debt without cashing out your 401(k)

Image: 5-ways-pay-off-debt

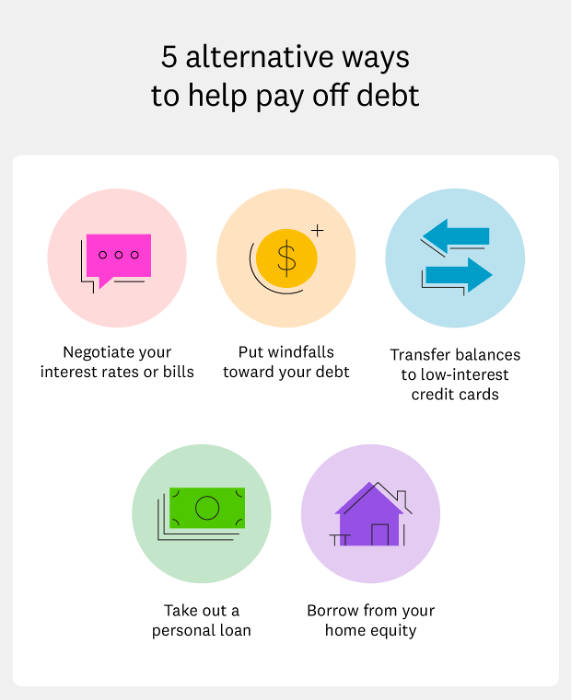

Image: 5-ways-pay-off-debtThere are several tactics to consider to help your goal of becoming debt-free without dipping into your 401(k). Paying off debt may not be easy, but it could benefit your future self and your current state of mind.

1. Negotiate interest rates or bills

Call your credit card customer service center and ask to lower your rates on high-interest accounts. Look at your current interest rate, account history and competitor rates. After researching, call your credit card company and discuss your customer history.

If you find a competing credit card company offering a better rate, try following up with your current card issuer to see if they’ll match the competitor’s rate. Securing lower interest rates may save you in interest payments.

You may also be able to negotiate your medical bills based on financial hardship or see if your provider offers an interest-free payment plan.

2. Put windfalls toward your debt

Any time you receive a bonus or other unexpected financial windfall, consider putting it toward debts. This could be in the form of a raise, yearly bonus, tax refund or monetary gifts from your loved ones.

Using this supplemental income to pay off all or part of a debt can shave off your total interest paid or free up money from your monthly budget.

3. Transfer balances to a low-interest credit card

If high interest credit card payments diminish your budget, consider transferring them with a balance transfer card.

A card with a lower interest rate will help you save on interest payments, though it won’t eliminate your debt completely. And keep in mind that unless you can find a credit card issuer that will waive its balance transfer fees, you may also have to pay that cost.

4. Take out a personal loan

A personal loan may also help you consolidate debt into a more manageable monthly payment if you can qualify for a lower rate than your existing debt.

Personal loans are a type of installment loan, which means you’ll have a fixed interest rate and predictable monthly payments, similar to an auto loan.

5. Borrow from your home equity

If you own a home, another option to consider is using home equity you’ve built off to pay off debt.

You may be able to do this by taking out a home equity loan, home equity line of credit (HELOC) or a cash-out refinance. But remember that this new debt is secured by your home, so you could lose your residence if you default in the future.

FAQs about using a 401(k) to pay off debt

No, cashing out a 401(k) won’t hurt your credit, but it can cost you in extra fees and taxes if you make an early withdrawal without a valid exception.

Once you reach the age of 59½, you can withdraw from your 401(k) without the additional 10% tax on early withdraws.

Like 401(k) accounts, you can withdraw from an IRA to pay off debt, but it may not be the best idea. You will also be subject to a 10% additional tax penalty if you withdraw before the age of 59½.