In a Nutshell

Causes of inflation generally break down into two categories, demand-pull inflation and cost-push inflation. As for current inflation, the main contributing factors include the increase in the money supply, supply chain disruption and fossil fuel policies.Inflation is an economic condition that sees the price of goods and services increase over time.

Economists typically focus on two primary types of inflation. Throughout this article, we’ll explore each of these types, analyze the various factors that can influence inflation rates, consider strategies experts recommend for combating inflation and offer advice on what actions you can take to mitigate its impact.

However, before we cover those topics, let’s take a closer look at the current causes of inflation and their effects on your purchasing power.

- What is causing inflation in 2023

- What are the general causes of inflation?

- Possible factors influencing inflation

- Counteracting the effects of inflation

- What’s next: Plan for the future

What is causing inflation in 2023

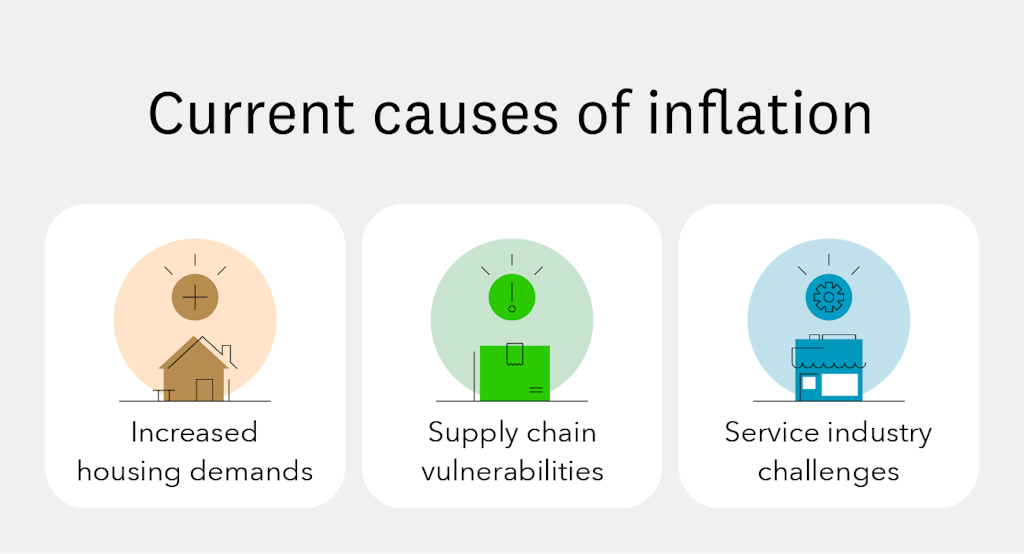

Over the past two years, you’ve probably noticed that prices have been rising on everything from grocery items to gas. In 2023, through September, consumer prices were up 3.7%. That’s the power of inflation. But what’s currently causing inflation and this painful strain on your wallet? Concerning the current economy, there are a few causes.

Image: current-causes-of-inflation

Image: current-causes-of-inflationIncreased housing demands

The COVID-19 pandemic led to a major surge in housing demand, which led to a substantial rise in housing prices. The pandemic also forced many people to work remotely, resulting in a desire for larger homes with more space.

With demand for housing on the rise, the costs of building materials, labor and land also increased. This rise in the cost of living has affected those looking to purchase a home as well as those who rent, as landlords raise prices to cover their own increased expenses.

Supply chain vulnerability

From 2022 to 2023, there was a sizable uptick in the cost of goods, primarily driven by the fragility of supply chains. With an increased demand for products worldwide, the pressure on supply chains grew.

Because of supply chain congestion, inflation surged in the automobile business. This industry had earlier been only a minor contributor to inflation — but that has changed. As of 2023, the auto industry was under a production shortfall of around 5 million vehicles, primarily due to production shutdowns during lockdowns and the scarcity of semiconductors.

Consumers choosing goods over services

In 2020, the U.S. saw a dip in the purchase of services and a rise in the purchase of goods. One reason for this included lockdowns, which forced businesses like gyms and restaurants to close. As a result, consumers shifted their purchases to alternatives like in-home gym equipment and groceries.

With the gradual reopening of the economy and the return of consumer demand to prepandemic levels, service prices have surged while the price of goods is stabilizing, leading to a rise in overall inflation.

What are the general causes of inflation?

It’s important to take the time to dive deeper into inflation as a whole so you can better understand how and why inflation occurs and how that plays into the economic impact consumers experience.

Two main factors generally cause Inflation.

- Demand-pull inflation — Demand-pull inflation occurs when demand for goods and services exceeds the economy’s capacity to meet that demand. When this happens, prices tend to go up, resulting in rising inflation.

- Cost-push inflation — Cost-push inflation occurs when prices rise because of supply issues. So, for example, if businesses can’t keep up production of manufactured goods because of rising raw material prices, they’ll have to sell manufactured goods at higher price points.

Here are the some of the typical causes of cost-push and demand-pull inflation.

Causes of demand-pull inflation

Demand-pull inflation happens when high consumer demand exceeds the total supply. Some of the most common causes of demand-pull inflation include …

- Economic growth — As economies grow and people have more money, they may feel more confident about buying goods and services. This causes the costs of goods and services to increase, as more people can now afford a greater amount of scarce products.

- The expectation of inflation — Sometimes, if enough businesses expect inflation, they increase their prices in anticipation. This expectation itself then causes its own inflation.

Causes of cost-push inflation

Cost-push inflation occurs whenever the supply end of the production chain experiences cost increases. That includes situations like …

- Raw material costs — Sometimes, the price of raw materials increases. For example, there may be a shortage of a certain type of metal that a computer manufacturer needs to produce computer chips. This will increase the cost of the computer, as the company will likely have to spend more money to obtain the metal they need.

- Labor costs increase — If the price of labor goes up, the cost of the goods the labor produces will also increase.

In addition to these two broad types of inflation, many factors can influence inflation. We’ll go over those next.

Possible factors influencing inflation

Image: factors-that-can-impact-inflation

Image: factors-that-can-impact-inflationWhen policymakers and other experts are concerned about inflation, the following are some of the most common factors they monitor:

Cost of production

If the cost of production increases, it’s likely that companies will increase the cost of goods and services. As noted above, this is one of the causes of cost-push inflation.

Prices of goods

When the prices of many goods go up (whether because of cost-push or demand-pull inflation), this is a sign of general inflation across the economy.

Demand for goods

If the demand for goods is increasing — for example, because of low unemployment — it’s likely the cost of goods will increase too, at least before production can catch up. That could spur inflation.

Skilled labor availability

The availability of skilled labor is another potential cause of inflation. If labor necessary to produce certain products is scarce, then the cost of those products will likely increase.

Current money supply

The amount of money currently in circulation can also affect inflation. When more money is in the economy, it may decrease the relative value of a unit of currency. This is why some economists believe printing more money to pay for government spending could result in inflation.

Counteracting the effects of inflation

A little bit of inflation is normal in most economies. Still, rapid inflation can be a detriment to society, as people can no longer afford many of the goods and services they rely on.

The ways that governments can counteract the effects of inflation vary, depending on the type of inflation and the factors causing it.

While certain policies could help, you can take action to help safeguard your finances and hedge against inflation. Here are some options.

- If possible, invest. Because of inflation, money slowly loses value if you leave it in a savings account — or worse, a checking account. Certain investments may be able to offset the effects of inflation. Stocks, Treasury Inflation-Protected Securities (or TIPS), money markets and certificates of deposit may be worth considering. However, it’s crucial to remember that such investments come with their own risks.

- Request a raise. Your salary may no longer have the same value if you haven’t received a raise in a while. With increasing inflation, your monthly income is worth less and less. To counteract this, you could consider asking for a raise to keep up with the rising expenses.

- Organize your workplace. If you and your coworkers have not received raises, it may be time to consider workplace organizing. By banding together with your coworkers, you may be able to negotiate with your employer to secure higher wages to offset the effects of inflation.

What’s next: Plan for the future

If you’re curious how your income, debts, investment tracking and other factors stack up against inflation, you’ll want to maintain a holistic view of your finances. Consider how your budgeting and investing strategies are preparing you for potential economic problems, and make adjustments if necessary.

Sourcing

- Causes of inflation in 2023. Inflation in 2023: Causes, Progress, and Solutions (March 2023)

- An increase in crude oil prices historically affects consumer pricing. Exploring price increases in 2021 and previous periods of inflation (October 2022)

- Factors influencing inflation. The Economics of Inflation (October 2021)

- Increase new home costs. New-Home Costs Rising at Unparalleled Rate (June 2022)