In a Nutshell

Annual income is the total income you earn in one year before deductions and can be a good indicator of your overall financial health. It’s also used to qualify for personal loans, credit cards and mortgages.Annual income is the amount of income you earn in one fiscal year. Your annual income includes everything from your yearly salary to bonuses, commissions, overtime and tips.

You may hear it referred to in two different ways: gross income and net income. Gross annual income is your earnings before tax, while net annual income is the amount you have after deductions. This topic is important if you’re a wage earner or a business owner, particularly when filing your taxes and applying for loans.

In this article, we’ll break down what annual income is, how to calculate your income and why understanding your annual income is important.

- What does annual income include?

- How to calculate annual income

- Why it’s important to calculate your annual income

What does annual income include?

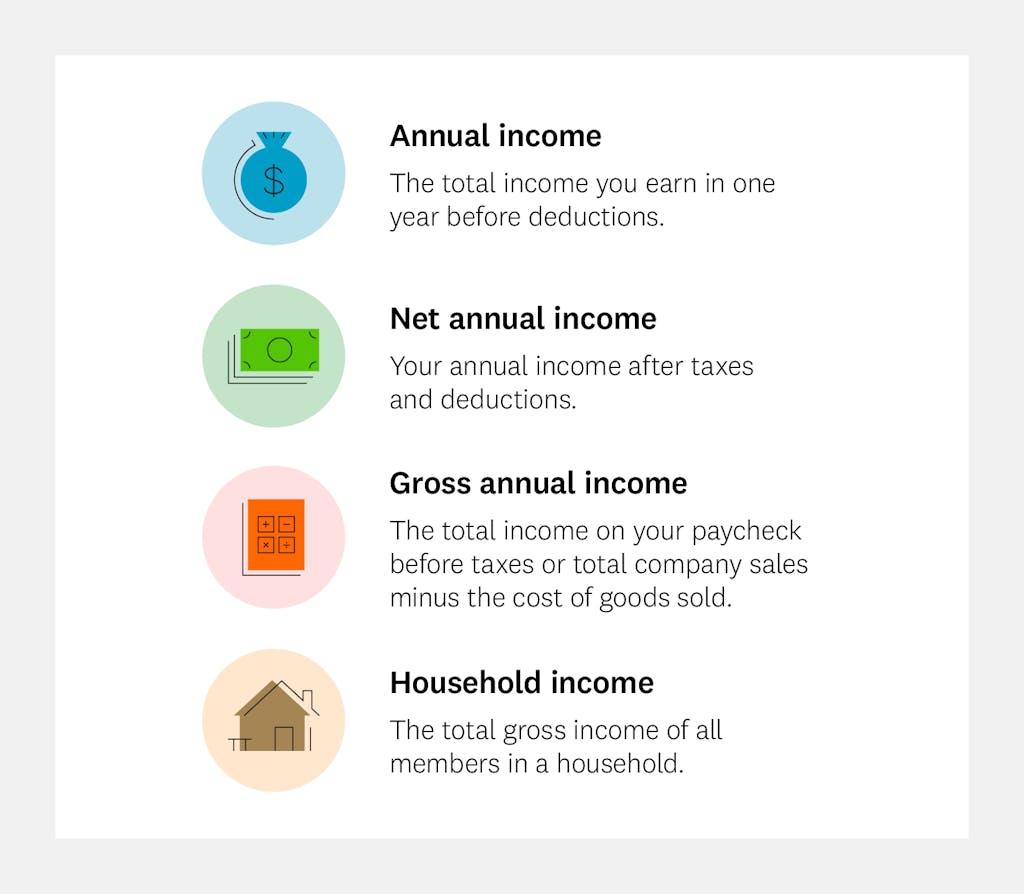

Annual income refers to how much income you earn in one year before deductions.

Annual income includes:

- Wages, salary, overtime pay, commissions and tips or bonuses before deductions

- Any Social Security benefits, retirement funds or pensions

- Disability assistance

- Court-ordered alimony or child support payments

- Net income from operating a business or a second job

- Lottery winnings, interest, dividends and any other net income from investments

Image: what-does-annual-income-include-1

Image: what-does-annual-income-include-1Net annual income

Net annual income is your annual income after taxes and deductions. This is what you’d use to make a budget since it’s what you have available for essentials such as housing, utilities, food and transportation.

In business, net income, also called net profit, is the money a company has left after they’ve paid all operating costs.

Gross annual income

Gross annual income can mean two different things, whether you’re looking at the annual income for your business or your personal account.

Personal gross annual income is the amount on your paycheck before taxes and deductions.

Gross business income is on your business tax return. Gross income in business is the total company sales minus the cost of goods sold. This number is what investors look at when assessing a potential company.

When preparing and filing your income tax return, gross annual income is the base number you should start with. By calculating your gross income, you’ll have a better idea of whether you’ll owe taxes and how much. Lenders and banks will also use your gross annual income to qualify you for a loan or a credit card.

Household income

Household income is the total gross income of all members in a household. It includes any person 15 years or older, and individuals don’t need to be related to make up your household income.

How to calculate annual income

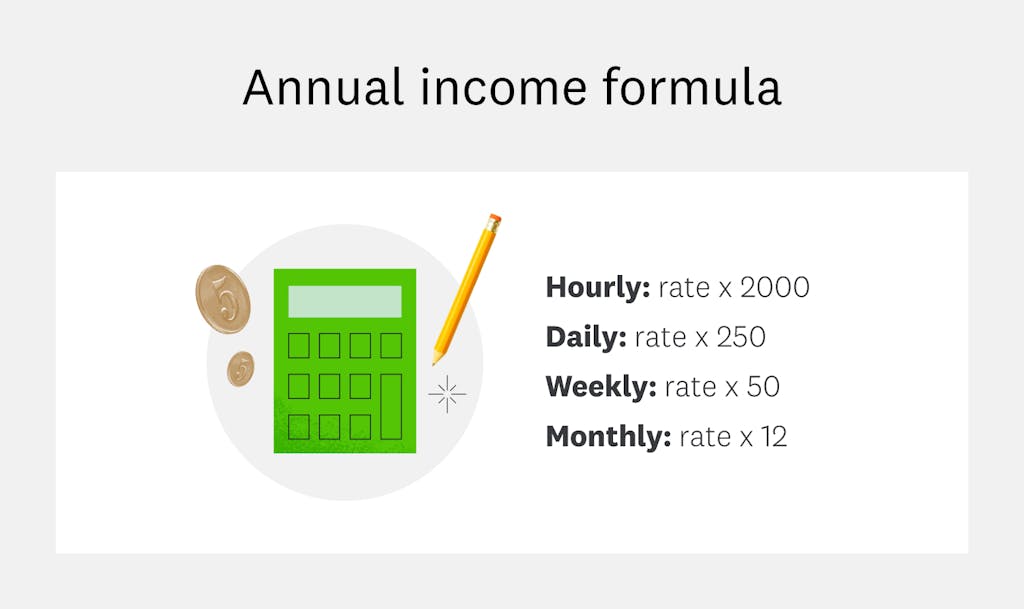

Generally, you can calculate your annual income — the total income you earn in a year — with a simple formula. This same formula will also work to calculate your annual salary — the total amount of money your employer pays you in a year.

Assuming you work an average of 40 hours per week and 50 weeks per year, convert your hourly, daily, weekly or monthly wages with the formula below to get your annual income.

Image: annual-income-formula

Image: annual-income-formulaFor example, let’s say John earns an hourly wage of $25 and works eight hours per day, five days per week and 50 weeks per year. Using the formula above, John earns an annual salary of $50,000.

Why it’s important to calculate your annual income

Your annual income and household income are good indicators of your financial health. Your financial state impacts your purchase decisions and way of living. If you have a clear picture of your annual income, you can identify your expenses, create a budget and better understand where and how you spend your money.

When it comes to getting a mortgage, lenders typically focus on your annual income and whether you’ve earned a consistent income for at least two years. The consistency of your income as well as your debt-to-income ratio give lenders insight into how your handle your finances.

Bottom line

Whether it’s applying for a personal loan, a new credit card or gathering the paperwork for your annual tax return, knowing your annual income can save you both time and stress. It’s important to understand your annual income and how to calculate it when evaluating the health and future of your personal or business finances.