In a Nutshell

Jobs that make a lot of money can help you have more financial security. The careers that make the most money tend to be in medicine and technology as well as management positions.Deciding what career to pursue can be a tricky decision when you’re first starting out.

But planning for your education and researching potential salary may help guide your decision.

We’ve analyzed 70 of the highest-paying jobs in the U.S. according to the U.S. Bureau of Labor Statics National Occupational and Wage Estimates using data from May 2022. Average annual salary is the data provided under annual mean age and sorted from highest to lowest.

- The benefits of a high-paying job

- 1. Cardiologist

- 2. Orthopedic surgeon

- 3. Pediatric surgeon

- 4. Surgeon

- 5. Radiologist

- 6. Dermatologist

- 7. Emergency medicine physician

- 8. Oral and maxillofacial surgeon

- 9. Anesthesiologist

- 10. Obstetrician and gynecologist

- 11. Ophthalmologist

- 12. Neurologist

- 13. Pathologist

- 14. Psychiatrist

- 15. Chief executive

- 16. Physician

- 17. Airline pilot, copilot and flight engineer

- 18. General internal medicine physician

- 19. Family medicine physician

- 20. Orthodontist

- 21. Nurse anesthetist

- 22. Pediatrician (general)

- 23. Dentist

- 24. Computer and information systems manager

- 25. Architectural and engineering manager

- 45 additional high-paying careers

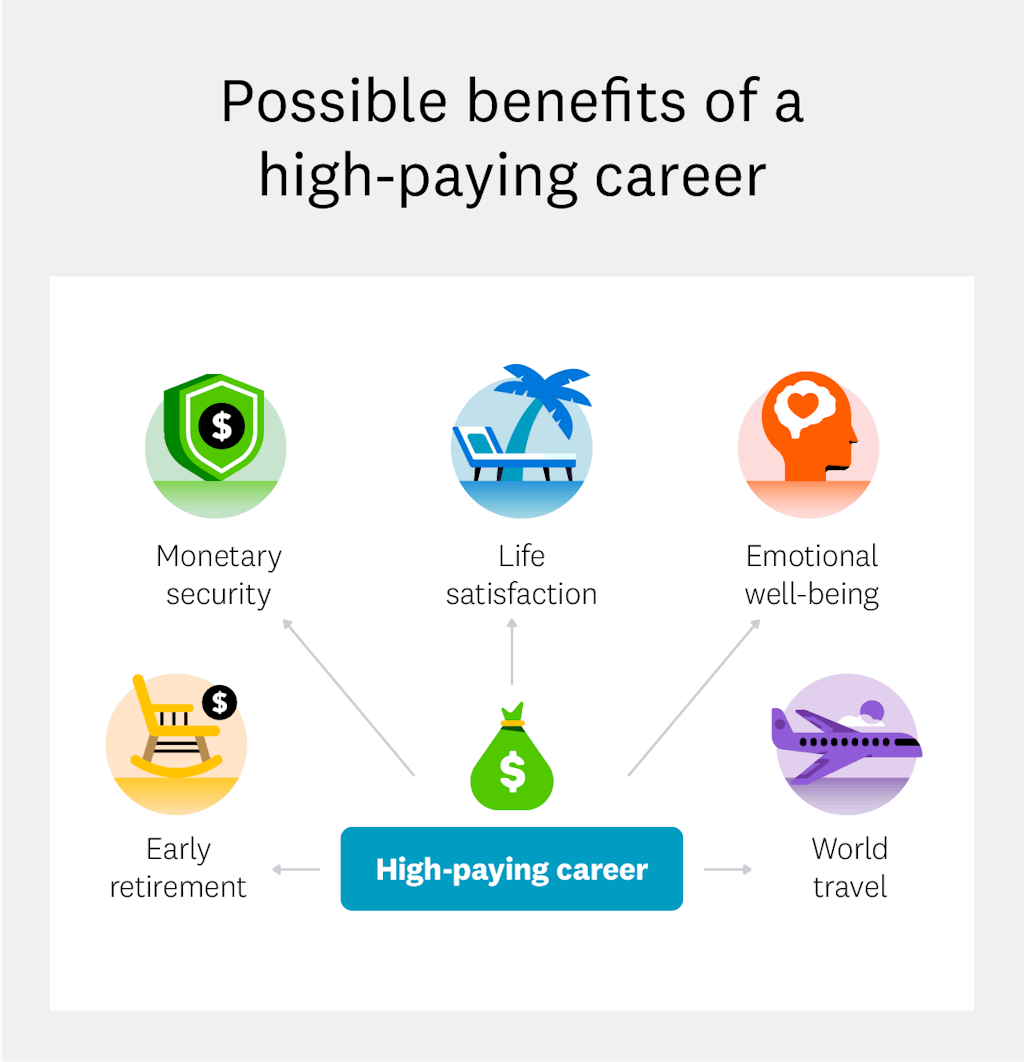

The benefits of a high-paying job

Choosing a career that pays well will almost certainly benefit your future. Whether you are looking to start a family, save for retirement or travel around the world, finding a high-paying career can get you a step closer to your goal.

Studies also show that larger incomes are generally associated with greater well-being and higher overall happiness.

Image: possible-benefits-to-high-paying-job

Image: possible-benefits-to-high-paying-job1. Cardiologist

Cardiologists diagnose, treat and prevent diseases affecting the cardiovascular system (the heart and blood vessels). This can include heart arrhythmias, heart attacks, coronary artery diseases, anginas, heart defects and infections. While cardiologists may insert pacemakers or complete angioplasty, they are not heart surgeons.

Average annual salary: $421,330

Requirements:

- Bachelor’s degree

- Medical school

- Residency (three years)

- Optional advanced training in specialty areas (three or more years)

- Board certification

2. Orthopedic surgeon

Orthopedic surgeons evaluate and treat musculoskeletal diseases or defects, often by surgery. Orthopedic surgeon specialties include hand surgeon, foot and ankle surgeon, orthopedic trauma, sports medicine, pediatric orthopedics and other areas.

Average annual salary: $371,400

Requirements:

- Bachelor’s degree

- Medical school

- Residency (five years at a minimum)

- Optional fellowship (one year)

- State licensure

- Board certification

3. Pediatric surgeon

If you like interacting with children, you may enjoy becoming a pediatric surgeon. Pediatric surgeons care for infants, children and young adults by performing a variety of surgeries. Becoming a pediatric surgeon may require an extra sharp eye since children can’t always articulate what hurts or where.

Average annual salary: $362,970

Requirements:

- Bachelor’s degree

- Medical school

- Residency in general surgery (five years)

- Fellowship in pediatric surgery (three years)

- Board certifications (in general surgery and pediatric surgery)

4. Surgeon

Working together with anesthesiologists, surgeons operate on patients who have suffered from injuries or diseases. There are many kinds of surgeons, including a general surgeon or specialists like neurosurgeons and cardiovascular surgeons.

Average annual salary: $347,870

Requirements:

- Bachelor’s degree

- Medical school

- Residency (five years)

- State license

5. Radiologist

Radiologists are doctors who analyze medical imaging such as MRIs and CT scans to help evaluate and treat patients. Radiologists can also perform medical procedures.

Average annual salary: $329,080

Requirements:

- Bachelor’s degree

- Medical school

- Internship (less than a year)

- Residency

- Certification from American Board of Radiologists

6. Dermatologist

Dermatologists evaluate and treat disorders of the hair, skin and nails. This can include skin cancer, hand dermatitis, moles, acne and more. Compared to other professions in the medical field, dermatologists enjoy a degree of flexibility in their schedules.

Average annual salary: $327,650

Requirements:

- Bachelor’s degree

- Medical school

- Residency

- State licensure

- Board certification

7. Emergency medicine physician

Emergency medicine physicians are among the first responders in an emergency. They make immediate decisions to try and prevent further injury or death to the patient. They recognize medical problems, provide care and stabilize patients.

Average annual salary: $316,600

Requirements:

- Bachelor’s degree

- Medical school

- Residency

- State licensure

- Board certification

8. Oral and maxillofacial surgeon

Oral and maxillofacial surgeons are dentists who perform surgeries on the mouth, jaw and face. They may also diagnose and treat problems in that area and perform surgery to improve the function and appearance of the patient’s facial structure.

Average annual salary: $309,410

Requirements:

- Bachelor’s degree

- Dental school

- Residency

- State licensure

- Board certification

9. Anesthesiologist

An anesthesiologist is a doctor who administers anesthetics and analgesics before, during or after surgery. They are critical to surgical procedures since they allow the surgeon and other physicians to complete invasive procedures without discomfort the patient would otherwise experience.

In addition to administering general and regional anesthesia, they help patients manage pain post-surgery.

Average annual salary: $302,970

Requirements:

- Bachelor’s degree

- Medical school

- Residency

- Fellowship (optional)

- Board certification (optional)

10. Obstetrician and gynecologist

From providing reproductive system care to bringing a new life into the world, obstetricians and gynecologists play an important role in reproductive health. They help prevent, diagnose and treat conditions affecting the female reproductive system. Gynecologists primarily handle reproductive health, and obstetricians deal with childbirth in the surgical field.

Average annual salary: $277,320

Requirements:

- Bachelor’s degree

- Medical school

- Residency

- Board certification

11. Ophthalmologist

Ophthalmologists are physicians and surgeons who provide corrective vision care as well as perform eye surgeries when needed. Ophthalmologists can prescribe contacts or glasses, perform LASIK and other eye surgeries. Some ophthalmologists work in research to prevent or cure eye diseases and disorders.

Average annual salary: $265,450

Requirements:

- Bachelor’s degree

- Medical school

- Residency

- Board certification

- Optional fellowship for subspecialty

12. Neurologist

Neurologists treat diseases and disorders of the nervous system, including the brain, spinal cord and nerves. They may treat sleep disorders, seizure disorders, neurodegenerative diseases or speech and language disorders. Neurologists do not perform surgery.

Average annual salary: $255,510

Requirements:

- Bachelor’s degree

- Medical school

- Internship

- Residency

- Fellowship (optional)

13. Pathologist

Pathologists study samples in the laboratory to better understand disease and injury. In turn, this informs the development of new medical treatments and technologies. Pathologists may also study samples from autopsies to help determine the cause of death.

Average annual salary: $252,850

Requirements:

14. Psychiatrist

Mental health is as important as physical health, so if you’re fascinated about how the mind works, becoming a psychiatrist can help you understand the relationship between the mind and body. Psychiatrists diagnose, treat and help prevent issues such as bipolar disorder, depression, ADHD and schizophrenia. They can also prescribe medications.

Average annual salary: $247,350

Requirements:

- Bachelor’s degree

- Medical school

- Residency

- License

- Certification from the American Board of Psychiatry and Neurology

15. Chief executive

At the highest level of management of a company, chief executives decide and formulate company policies according to the guidelines set up by a board of directors.

They are not only tied to planning, directing and coordinating operational activities within the company but also act as a leader to help the company meet its goals.

Average annual salary: $246,440

Requirements:

- Bachelor’s degree

- Business and industry experience

16. Physician

Physicians can diagnose and treat illnesses or injuries and help maintain the patient’s overall health. There are two main types of physicians: doctors of osteopathy, who specialize in preventive medicine and holistic care, and doctors of medicine. However, within these types, you could choose to have a specialty such as urology, immunology, or radiology, to name a few.

Average annual salary: $238,700

Requirements:

- Bachelor’s degree

- Medical school

- Residency

- License

- Optional fellowship

17. Airline pilot, copilot and flight engineer

Pilots operate and fly airplanes transporting passengers and cargo. As a pilot, you can fly aircraft regionally, nationally and internationally or even become a flight instructor.

Average annual salary: $225,740

Requirements:

- Bachelor’s degree (recommended)

- Training from a flight school or an independent instructor

- Commercial pilot’s license

- Airline Transport Pilot certificate (for commercial airline pilots)

18. General internal medicine physician

General internal medicine physicians diagnose and treat a variety of injuries and diseases relating to the internal organs. Commonly referred to as general internists, they primarily treat adults and adolescents and are trained to handle various illnesses.

Average annual salary: $225,270

Requirements:

- Bachelor’s degree

- Medical school

- Internal medicine residency

- License

19. Family medicine physician

If you don’t want to be tied to diagnosing and treating a particular health condition, becoming a family medicine physician may be a good career option. They diagnose, treat and provide preventive care.

Average annual salary: $224,460

Requirements:

- Bachelor’s degree

- Medical school

- Family medicine residency

- License

20. Orthodontist

Orthodontists diagnose, examine and treat imperfect positioning of teeth. By prescribing and applying braces, orthodontists help improve not only mouth and teeth function but also the appearance of patients’ smiles.

Average annual salary: $216,320

Requirements:

- Bachelor’s degree

- Dental school

- Residency

21. Nurse anesthetist

Nurse anesthetists administer anesthesia to patients as well as monitor their vital signs and their recovery from anesthesia. They are registered nurses who specialize in anesthesiology and assist surgeons and physicians with procedures.

Average annual salary: $205,770

Requirements:

- Bachelor’s degree

- Master’s degree in nursing

- Nurse anesthetist certification

22. Pediatrician (general)

Pediatricians diagnose, treat and help prevent injuries and diseases in children from infancy to adulthood. For more specific treatment, they might also refer them to a specialist. Pediatricians can work with the whole family and acquire a subspecialty, such as oncology or developmental-behavioral pediatrics.

Average annual salary: $203,240

Requirements:

- Bachelor’s degree

- Medical school

- Residency

- License

23. Dentist

Dentists diagnose and treat issues with the mouth, gums and teeth. Dentists treat more than just cavities — they extract teeth, perform teeth cleaning and fit dentures.

Average annual salary: $180,900

Requirements:

- Bachelor’s degree

- Dental school

- License

24. Computer and information systems manager

Computer and information systems managers plan, coordinate and direct activities in electronic data processing, computer programming, information systems and systems analysis. They are there to help companies and organizations navigate technology. In addition to supervising workers, they also help install and upgrade systems and protect them from potential threats.

Average annual salary: $173,670

Requirements:

- Bachelor’s degree

- Industry certifications and experience

25. Architectural and engineering manager

As an architectural and engineering manager, you plan, direct and coordinate architectural and engineering activities or work on research and development. Some managers work in offices designing and coordinating the creation of safe and purposeful buildings. Others may also work in research laboratories and construction sites.

Average annual salary: $163,310

Requirements:

- Bachelor’s degree

- Industry certifications and experience

45 additional high-paying careers

If the careers mentioned above aren’t a fit for you, there are plenty of other jobs that pay good salaries. Here are 45 additional careers that make the most money, sorted by average annual salary.

- Athlete and sports competitor — $358,080

- Financial manager — $166,050

- Lawyer — $163,770

- Natural science manager — $163,610

- Lawyers and judicial law clerks — $161,680

- Marketing manager — $158,280

- Podiatrist — $157,970

- Computer and information research scientist — $155,880

- Judge, magistrate judge and magistrate — $153,700

- Sales manager — $150,530

- Physicist — $150,130

- Public relations manager — $150,030

- Operations specialties manager — $148,190

- Human resources manager — $145,750

- Compensation and benefits manager — $143,140

- Petroleum engineer — $142,800

- Managers (other) — $141,190

- Computer hardware engineer — $140,830

- Purchasing manager — $140,650

- Personal financial advisor — $137,740

- Database architects — $136,540

- Optometrist — $133,100

- Software developer — $132,930

- Training and development manager — $132,100

- Air transportation worker — $131,630

- Air traffic controller — $130,840

- Computer network architect — $129,490

- Pharmacist — $129,410

- Top executive — $129,050

- Economist — $128,180

- Medical and health services manager — $127,980

- Health specialties teacher, postsecondary — $127,640

- Actuary — $127,580

- Astronomer — $127,460

- Aerospace engineers — $127,090

- Political scientist — $126,140

- Sales engineer — $125,460

- Physician assistant — $125,270

- Nurse practitioner — $124,680

- Nuclear engineer — $124,540

- Fundraising manager — $124,450

- Art director — $124,310

- Economics teacher, postsecondary — $122,750

- Industrial production manager — $120,900

- Chemical engineer — $117,820