COVID-19, supply chain issues and the global semiconductor chip shortage are just a few of the world affairs that have affected the auto market since early 2021. New and used car prices have skyrocketed. Average new car sales reached a high point in September 2022 at $45,031 and average used car sales topped out in July 2022 at $28,219, according to Kelley Blue Book.

Supply chain issues have led to longer wait times for parts, increasing repair times. And the greater complexity of modern vehicles means greater reliance on high-tech support, which tends to be expensive given the in-depth training required and elevated operating costs.

Add an 8.3% rate of inflation from August 2021 to August 2022 and an increase in risky driving behavior, and it makes sense that a lot of people across the United States have seen their auto insurance bills increase.

Many auto insurance companies are raising their premiums — subject to the approval of each state’s department of insurance — to cover the increased costs of claims.

Wondering where your state ranks in average auto insurance premium growth?

Using Quadrant data, Credit Karma analyzed average auto insurance rate growth over the course of 21 months from July 2020 to April 2022 for a given driver profile (see the full methodology for details.)

Here’s a look at the five states that have seen monthly insurance rates go up the most during that period, according to our study of Quadrant rates.

| State | % increase (July 2020–April 2022) | $ increase (July 2020–April 2022) |

| South Carolina | 28% | $44 |

| Wisconsin | 27% | $28 |

| Arkansas | 23% | $42 |

| Connecticut | 23% | $35 |

| New Hampshire | 20% | $24 |

In contrast, here are the five states with the greatest decrease in monthly auto insurance premiums:

| State | % decrease (July 2020–April 2022) | $ decrease (July 2020–April 2022) |

| North Dakota | -23% | $36 |

| California | -14% | $35 |

| Hawaii | -14% | $15 |

| South Dakota | -13% | $16 |

| Washington | -12% | $19 |

Credit Karma Stat Snapshot

Greatest increase in average monthly car insurance premium between July 2020 and April 2022:

28%, South Carolina

Greatest decrease in average monthly car insurance premium between July 2020 and April 2022:

23%, North Dakota

Greatest increase in average monthly car insurance rate between October 2021 and April 2022:

30%, Connecticut

California hasn’t approved a car insurance rate increase since March 2020

Highest average monthly car insurance premium in the nation:

$429, New York

Progressive’s average monthly premium went up 17% between July 2020 and April 2022

Western states have seen an overall decrease in average monthly car insurance premiums since 2019

Calculations based on a standard driver persona. See methodology for details.

Which states have had the highest car insurance premium increases since 2020?

According to our study of Quadrant rates, monthly auto insurance rates have increased across the country by an average of $10 per month in the 21 months from July 2020 to April 2022 ($120 annually).

Of the 24 states that saw auto insurance rate increases during this time, South Carolina has spiked the most at 28%. North Dakota has seen the most drastic average monthly premium decrease during the same span, dropping 23%.

Hawaii’s monthly rates are second-cheapest nationwide, behind only North Carolina. New York’s average monthly auto insurance rates were the most expensive, followed by Louisiana and Michigan.

As this map shows, states in the eastern U.S. have the highest monthly auto insurance rates, while the Midwest has the cheapest. Since 2020, the Southeast has seen the highest rate increases.

Average auto insurance rate change from July 2020 to April 2022

Are auto insurance rates increasing?

Based on our research, car insurance premiums have increased an average of $10 per month since 2020. Car insurance rates dipped to as low as $161 per month on average in late 2021, but quickly rose. Between October 2021 and April 2022, auto insurance premiums have increased by an average of more than 5% ($9 per month) nationwide to $170 per month.

Auto insurance rate trends since 2021

According to our study of Quadrant rates, a total of 30 states saw their auto insurance rates increase in the six-month period from October 2021 to April 2022. Connecticut’s average auto insurance rates increased 30%, the highest such increase in the country during this time period.

| State | October 2021 rate | April 2022 rate | % increase | $ increase |

| Connecticut | $148 | $193 | 30% | $45 |

| Arkansas | $181 | $224 | 24% | $43 |

| New Hampshire | $117 | $143 | 22% | $26 |

| Georgia | $177 | $216 | 22% | $39 |

| Wisconsin | $108 | $131 | 21% | $23 |

Hawaii’s average monthly auto insurance premium fell 11% in the same six-month span — the greatest average auto insurance rate decrease of any state.

| State | October 2021 rate | April 2022 rate | % decrease | $ decrease |

| Hawaii | $106 | $94 | -11% | $-12 |

| Utah | $171 | $157 | -8% | $-14 |

| Arizona | $241 | $227 | -6% | $-14 |

| Michigan | $274 | $259 | -5% | $-15 |

| South Dakota | $119 | $114 | -4% | $-5 |

Car insurance premium increases by area

From October 2019 to April 2022, the biggest increase in average auto insurance premiums — from $168 to $190 — was in the northeastern United States. At the same time, car insurance rates in the western United States decreased during that time.

During the latter six months of that time period, northeast and southeast states saw a sudden increase in average insurance rates, while west and southwest states held relatively steady.

Average auto insurance rate change by region

Image: copy-avgai_region-copy

Image: copy-avgai_region-copyCar insurance premium increases by company

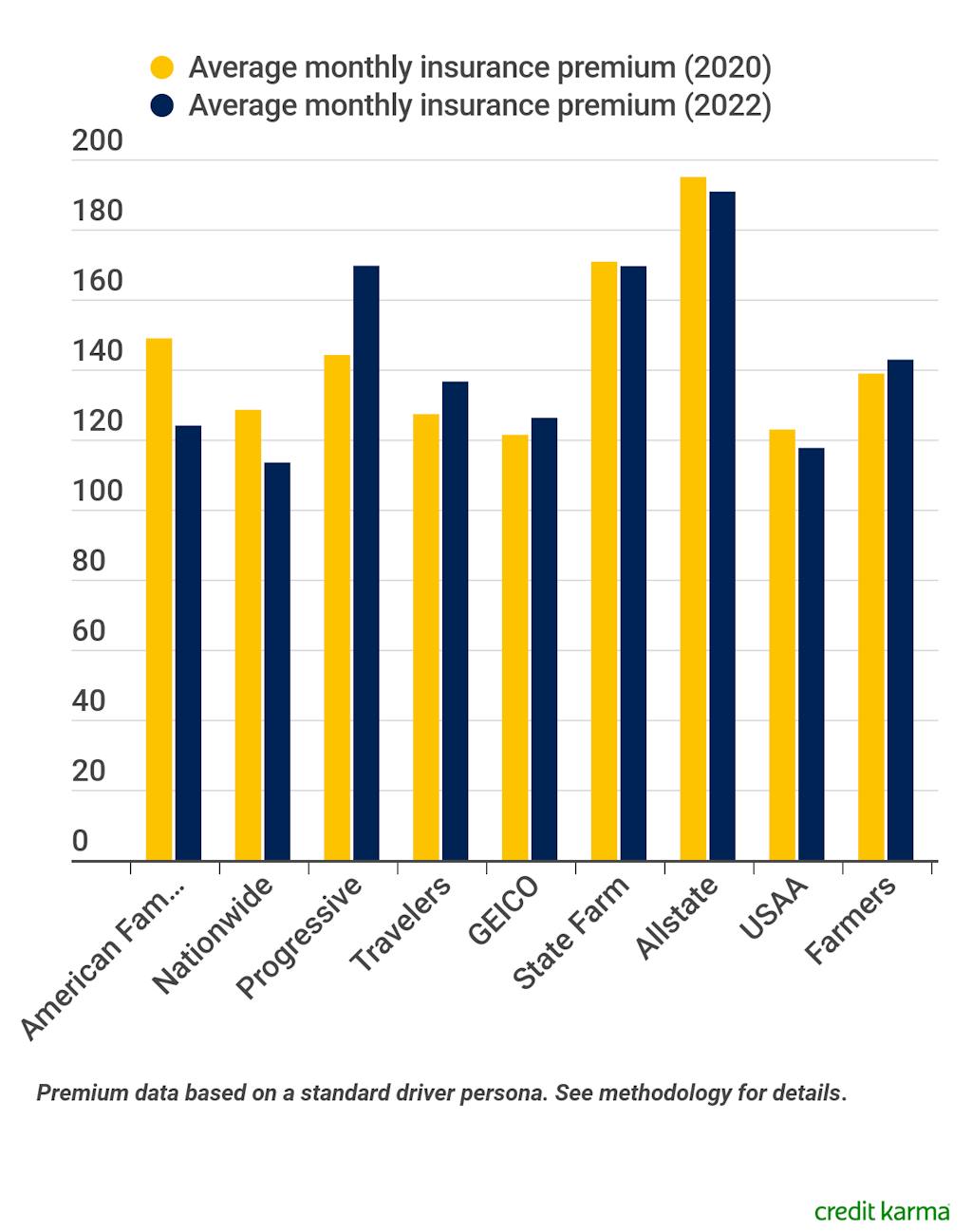

Smaller auto insurers make up the companies with the most drastic auto insurance rate changes per month in the 21 months from July 2020 to April 2022. Utica National Insurance Group, for example, has made the highest increase — a 226% average rate jump (from a monthly premium of $59.40 to $193.71) — at least for the driver personas we reviewed. The company primarily offers auto insurance in eastern states.

Wolverine Mutual, on the other hand, writes policies in three midwestern states and has seen the sharpest decrease in monthly premiums, lowering monthly premiums by up to 55% to an average of $102.80 per month.

Large auto insurance companies’ rate changes during this time period are less extreme in comparison. Progressive has increased its monthly rates by an average of 17%, while Nationwide has decreased monthly premiums by more than 11% on average.

Average monthly auto insurance premium (largest insurers)

Image: copy-avgai_company

Image: copy-avgai_companyCar insurance premium increases by age

Based on our study, auto insurance rates are the highest for young drivers between the ages of 18 to 21. As of April 2022, the average monthly car insurance premium for drivers in that age group are 57% more expensive than the cumulative average of all other age groups.

As a driver gets older (and more experienced), insurance rates typically decrease until a person touches the 55 to 64 age range. Drivers over the age of 65 have seen the highest rate of increase (8.16%) between October 2021 and April 2022.

Auto insurance rate change by age

Image: copy-avgai_age

Image: copy-avgai_ageFAQs about car insurance rates

Does your car insurance increase after a speeding ticket?

Probably, but it depends on your unique situation. According to Progressive, if the ticket is the first on your record, your insurance premium may not increase at all. However, if you get two speeding tickets in three years, it’s likely you’ll see an auto insurance premium increase. The potential rate hike depends on your unique situation and several factors like your insurance company, insurance history, driving record and others.

Does your car insurance increase after a claim?

An insurance company typically increases your premium by a percentage if you make a claim against your insurance policy above a certain amount and you’re at fault. The Quadrant data we examined shows that auto insurance premiums increase by 37% on average after the first claim, by an additional 38% after two claims and by an additional 41% at three claims. That means that a $170 monthly premium could turn into a $451 monthly premium after three claims.

At what age does your insurance go down?

According to our study of Quadrant rates, once a driver turns 22, their car insurance premium decreases an average of 25%, with their rate continuing to steadily decline until age 65.

At age 25, average premiums decrease 12% more. Drivers aged 36 to 45 see a further decrease of 5%, and those who hit the 46 to 54 age bracket see a decrease of an additional 6% before leveling out between the ages of 55 and 64.

Average premium per month by age in 2022

Image: aiage-1

Image: aiage-1Methodology

To identify auto insurance rate changes by state, we analyzed Quadrant Information Services data from October 2019, July 2020, February 2021, October 2021 and April 2022. Mention of the year 2020 references data from July 2020. Mention of the year 2021 references data from October 2021 and mention of the year 2022 references data from April 2022.

Rates provided fit the following profile, unless noted otherwise: The driver is between the ages of 26 and 35, drives a car valued between $15,000 and $20,000 and drives between 12,000 and 15,000 miles per year. The driver has been continuously insured for more than three years, has one vehicle on the policy, is the only driver and has no claims or tickets.

Quadrant Information Services doesn’t include all insurance companies in the rate data it provides. These are estimated rates meant only to provide a frame of reference and comparison. Your current rate or rates quoted to you may vary depending on a range of factors, such as your age, vehicle driving habits and history. Note that the rates are provided every six months by Quadrant Information services.

When referring to regions, the following is true:

- West: Alaska, Hawaii, Washington, Oregon, Idaho, Montana, Nevada, Utah, California, Colorado, Wyoming

- Southwest: New Mexico, Arizona, Texas, Oklahoma

- Midwest: North Dakota, South Dakota, Minnesota, Kansas, Nebraska, Iowa, Missouri, Wisconsin, Illinois, Indiana, Michigan, Ohio

- Southeast: Florida, Georgia, Alabama, Louisiana, Mississippi, Arkansas, North Carolina, South Carolina, Virginia, West Virginia, Tennessee, Kentucky

- Northeast: Pennsylvania, Rhode Island, Maryland, Connecticut, Maine, New Hampshire, Vermont, Massachusetts, Delaware, New York, New Jersey

All average rate data is rounded to the nearest whole number.