In a Nutshell

The differences between a bear vs. bull market are key to successful investing. A bull market is when market sentiment is optimistic, and there is a rise of 20% or more in market growth over two months. Conversely, a bear market is a time of economic downturn, pessimistic sentiment and broad market falls of 20% or more.The stock market can be tough to navigate for many investors — including those looking to enter the market for the first time. Approximately 58% of American adults invest in the stock market, and some beginners may wonder how bear and bull markets differ.

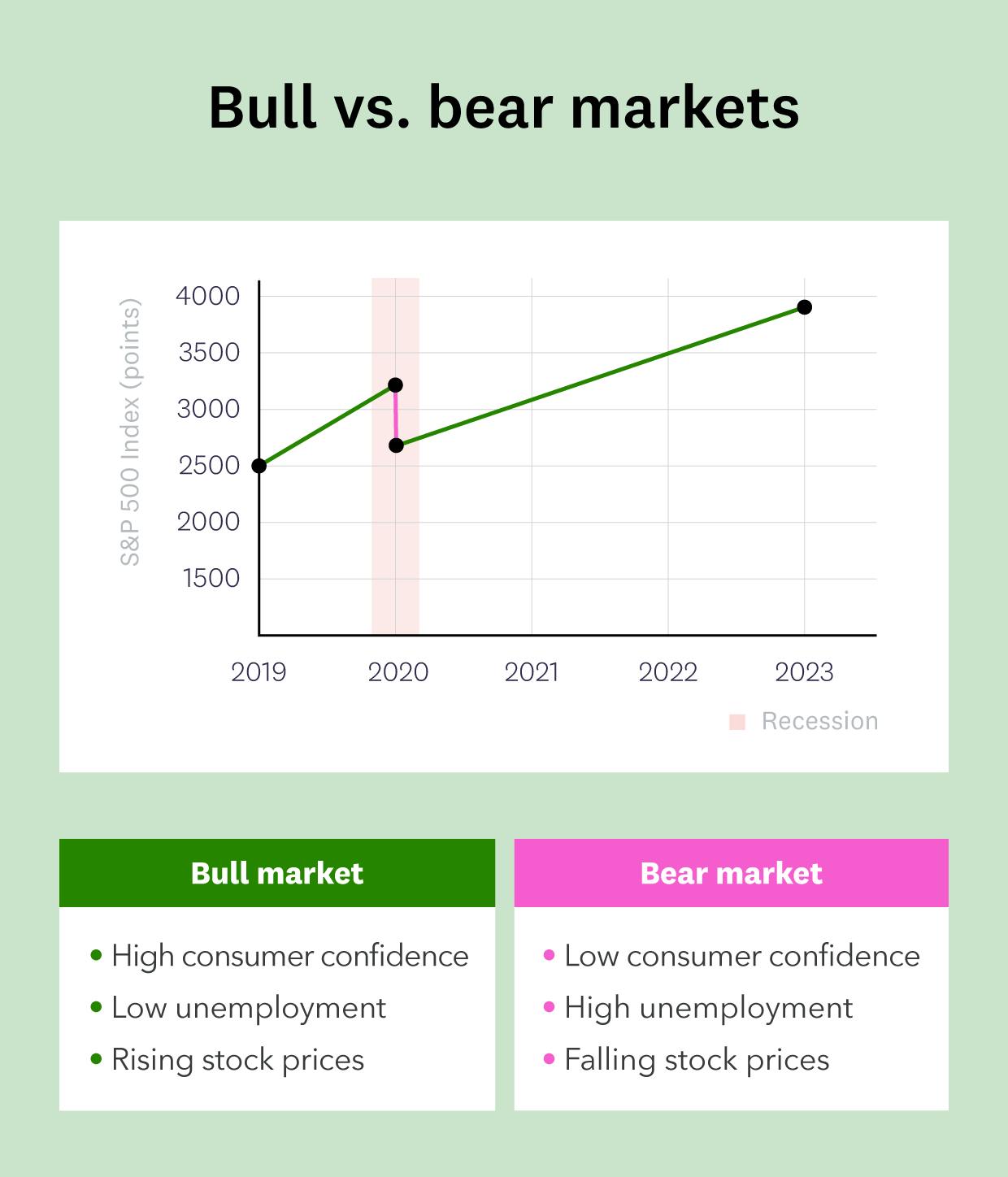

A bull market is usually characterized by rising stock prices and a generally optimistic economic outlook. In contrast, a bear market is marked by falling stock prices and a pessimistic outlook.

Understanding the differences between bear and bull markets is crucial for investors looking to make informed investment decisions.

- What is a bull market?

- What is a bear market?

- Differences between a bull market and a bear market

- What investors should do in bull and bear markets

- FAQs about bull and bear markets

What is a bull market?

A bull market is a time of economic growth and consumer confidence. During this time, market sentiment is optimistic, and there is a rise of 20% or more in broad market index. Additionally, bull markets can correlate with a growing economy and high employment rates.

What is a bear market?

A bear market is the opposite of a bullish market, representing an economic downturn and high unemployment rates. When a bear market occurs, stock prices will fall over 20%. These plummeting stock prices may lead investors to sell their securities for the safety of fixed-income securities.

Differences between a bull and bear market

Image: bull-vs-bear-markets

Image: bull-vs-bear-marketsTo better understand the economic conditions that lead to both bear and bull markets and what to look out for to protect your assets — it’s important to highlight a few key differences between bear and bull markets.

Investor attitudes

Regarding trading in bull and bear markets, investor attitudes tend to change depending on the current market. Investors are usually optimistic and eager to capitalize on the profits in a bullish market. To do so, investors may buy and hold onto their securities of choice, hoping to earn money as the prices trend upward.

In a bearish market, it’s the opposite. Instead, investors are doubtful and may not be willing to lose their investment value. To avoid losing money, investors may sell what they can and leave the market in favor of fixed-income securities.

Supply and demand

Supply and demand affect both bear markets and bull markets. For example, a bull market has a considerable demand for equities and securities. Because of this, there is a lower supply of stocks, further increasing the price.

During a bear market, you can expect to see the opposite. With many investors selling their stocks, the supply increases while the demand diminishes, sinking the stock price and leading investors to fear losing their investments.

Trends in investor behavior during bull and bear markets

Image: what-to-expect-in-fluctuating-markets

Image: what-to-expect-in-fluctuating-marketsWhat to do in a bull market

In a bull market, you may hear people saying that you need to take advantage of the rising prices. Many investors use the buy-and-hold strategy. When practicing this investment strategy, you will buy stocks to hold them while the prices increase.

The buy-and-hold strategy can be easier said than done, but those who execute the strategy tend to come out ahead of those who try to time the market. Remember that all investing comes with risk, and some people may choose to grow their money slowly instead by using low-risk savings products, such as savings accounts, insured money market accounts and CDs.

What to do in a bear market

Bear stock markets can be trickier, as it’s hard to say which companies may survive and bounce back with new profits and which may not. If you’re short-term investing, you may still profit by short-selling, buying inverse ETFs or put options, or putting your money into less-risky investments.

If you’re a long-term investor, it might be best to avoid selling when you see a downturn in the market. The stock market history shows the economy is likely to recover with time, and your holdings could begin to appreciate again.

FAQs about bull and bear markets

In a bull market, stock prices generally rise and can present opportunities to make profits quickly. Stock prices in a bear market generally fall and present opportunities to buy stocks at a lower price. Ultimately, the best time to buy depends on your investment goals, risk tolerance and overall market conditions.

On average, bear markets last an average of about one year, but they can last longer or shorter depending on the underlying economic conditions and market factors. Some of those factors include:

Economic data

Corporate earnings

Geopolitical tensions

Investor sentiment

The duration of bull markets is not fixed and can vary significantly, just like bear markets. Typically, a bull market lasts longer than a bear market. Historically, bull markets last about four to five years, but some have gone for much longer.

The bottom line

Before you start investing, here’s what to remember about bull markets and bear markets:

- A bull market is when stocks increase in value — improving the economy and employment rates. They usually last a couple of years.

- A bear market is when stocks lose value, the economy looks uncertain, and unemployment might increase. Bear markets tend to last a few months — but can be longer.

- Investor attitudes have a lot to do with how markets perform — investors might feel bullish, boosting stock prices, or bearish, causing them to decrease.

- Ultimately, your investment strategy depends on your personal risk tolerance. It can be wise to buy low and sell high during a bull market and to be cautious about investing during a bear market, but risks apply in both cases.

If you’re new to investing, you might not be ready to jump all in yet. You can start with low-risk investments like a high-yield savings account to see regular returns on your money.