In a Nutshell

Investing is an essential aspect of personal finance, and taking the first step can be life-changing. But common concerns and questions include how much to invest, when to start, and how to stay disciplined and informed. Whether you're looking to build long-term wealth or simply grow your savings, investing can effectively help you achieve your financial goals.Whether you’re looking to build long-term wealth or simply grow your savings, investing can be an effective tool to achieve your financial goals. However, investing for beginners can be overwhelming — especially if you’re not a big fan of taking risks. But that’s why doing your own research is essential. A well-informed investment strategy can help you minimize risk and increase your profit potential.

In this article, we’ll cover things you need to know as a beginner, from understanding the different types of investments to building a diversified portfolio and managing risk.

- Why is investing important?

- Step 1: Consider the key investing factors

- Step 2: Determine what kind of investor you are

- Step 3: Pick which type of investment is right for you

- Step 4: Sidestep common beginner investing mistakes

- FAQs about investing for beginners

- What’s next: Secure funding

Why is investing important?

Investing gives you the potential to grow your wealth over time, hedge against inflation, create passive income and save for retirement. Investing can provide a means to generate income and build wealth outside of traditional employment.

Image: 4-essential-steps-to-beginner-investing

Image: 4-essential-steps-to-beginner-investingStep 1: Consider the key investing factors

As you start exploring what to consider before investing your money, there are some investing concepts you should familiarize yourself with:

- Age — Consider your age when making long-term and short-term investments.

- Financial goals — Align investments with your long-term and short-term financial goals.

- Active or passive investing — Decide if you want to actively manage your investments.

- Taxes — Consider how taxes may reduce the returns you see on your investment.

- Personal finances — Determine the amount of income you can commit to investing.

- Risk tolerance — Consider the risk associated with your investments.

- Portfolio diversification — Spread your money across multiple investments to help reduce risk.

- Growth expectations — Think about how long it may take for your money to grow.

Step 2: Determine what kind of investor you are

Now it’s time to consider what type of investor you want to be. Some beginner investors like actively managing their investments, while others prefer to work with certified professionals.

Online broker investor

Online brokers can either be full-service or discount. As the name implies, full-service brokerages come with a full suite of services. You can expect to receive professional financial advice about your retirement, healthcare and anything else concerning your personal assets.

On the other hand, discount brokers focus on buying and selling orders at lower commission rates.

Robo-advisor investor

Robo-advisors are a type of discount broker that allow you to track and manage your investments in the palm of your hand. Their goal is to streamline the investing process for everyday people — including beginner investors — and to lower costs.

Investing through your employer

You can look into whether your employer offers employee investment plans. For example, you could commit a portion of your salary to a 401(k) retirement plan, if available. This option turns investing into a more hands-off project.

Step 3: Pick which type of investment is right for you

You have quite a few options when picking investments. Check out some of the most common investments for beginners.

401(k) plans

A workplace 401(k) plan may be a great option — especially since some employers will match your contributions. The percentage of your salary you decide to contribute will go straight from your paycheck into your retirement savings account.

Along with your employer-sponsored 401(k), an individual retirement arrangement (or IRA) is another way to save money for retirement.

Mutual funds

Mutual funds are another tool beginner investors use to start their portfolios. They allow you to reduce the risk of investing by splitting your investments among different types of securities, including stocks and bonds. Some prefer this because it can be a lower-cost option for professionally managed investments.

Exchange-traded funds

Managed by experts, an exchange-traded fund, or ETF, is a collection of stocks or bonds in a single fund that trades on major stock exchanges.

Bonds

A bond is a debt security, similar to an IOU, that’s issued by a government or a corporation to raise money. When you buy a bond, you’re giving the issuer a loan, and the issuer agrees to pay you back the face value of the loan on a specific date, and to pay you interest payments along the way.

High-yield savings and CDs

High-yield savings accounts come with little risk and typically offer higher interest rates on deposits than traditional savings accounts. However, these accounts do often come with balance requirements and withdrawal limitations.

Certificates of deposit are another form of investment with low risk and are similar to savings accounts. Their main difference lies in your agreement to keep your money untouched for a specific time, often facing penalty fees if you try to make early withdrawals.

As an added benefit, both savings accounts and CDs offered by a federally insured bank or financial institution are FDIC-insured up to $250,000, which will protect your money in the event of a market collapse.

Annuities

Retirees may find they need more than Social Security and investment savings to support their daily lives. Annuities can be a great solution because they provide a steady stream of income that you can’t outlive.

Secured by a contract between you and an insurance company, you would provide a lump sum of money that would grow over a certain period of time. Based on the contract you sign, you will then receive payments that can help support your lifestyle.

Individual stocks

Stocks are one of the most common forms of investing. A company uses its stock shares to fund operations and growth initiatives. People find individual stocks attractive because of the potential return they could receive if the company sees success.

Here’s how to buy stocks.

- Choose a brokerage firm. Look for a brokerage with affordable accounts for your budget with a good reputation.

- Open an account. For a speedy process, ensure you have your Social Security number, employment information and other personal details on hand.

- Deposit funds. You can do this in several ways, including a wire transfer that electronically transfers funds from your checking or savings account. Your brokerage firm will have more specific details on how to transfer funds.

Remember that the risk lies in the potential for the company to do poorly, which could lead to losses.

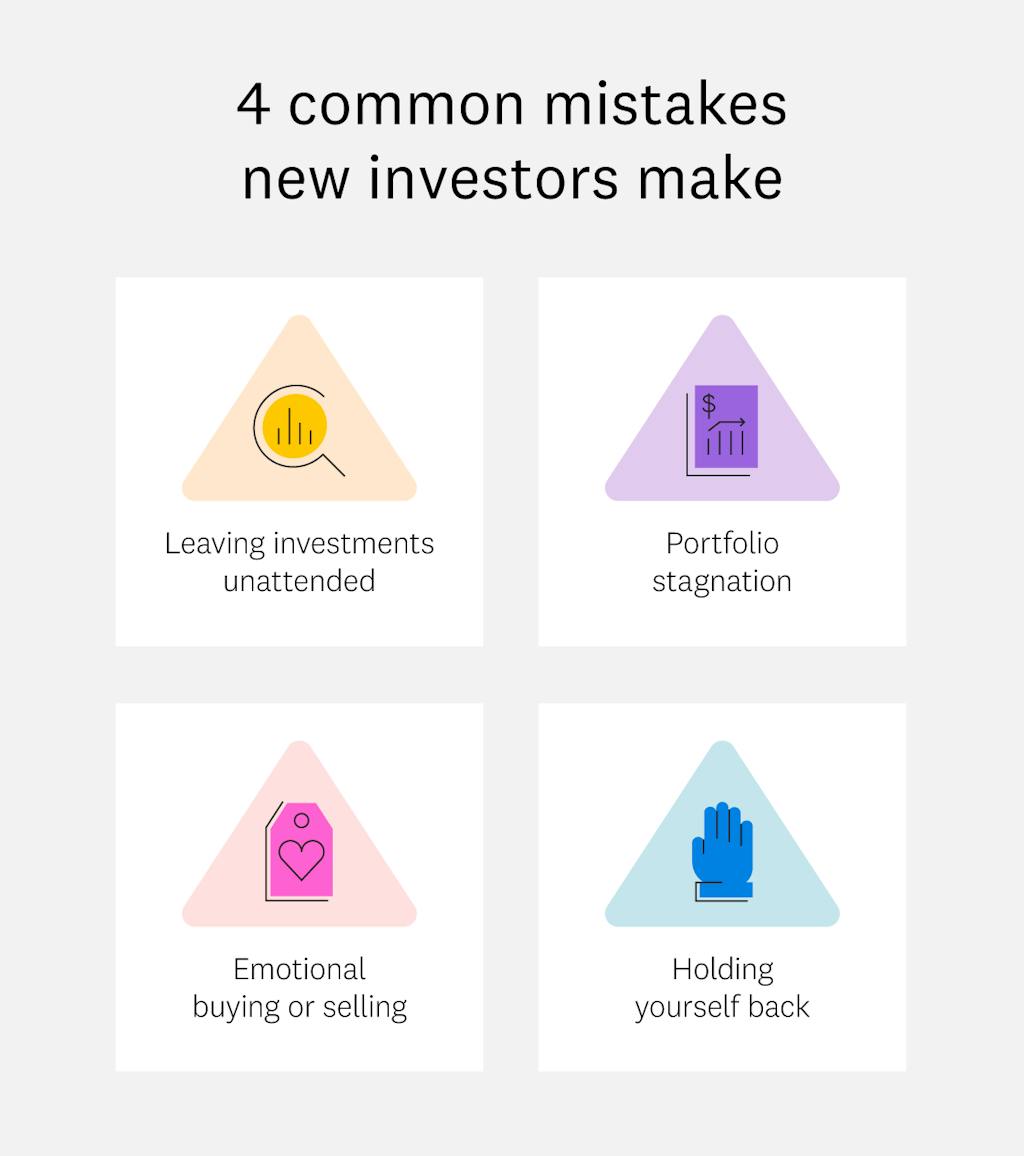

Step 4: Sidestep common beginner investing mistakes

Image: 4-common-mistakes-new-investors-make

Image: 4-common-mistakes-new-investors-makeInvesting can be difficult. Below, you’ll find some of the most common investing mistakes — and tips to avoid them. These include …

- Failing to review investments — Check on your investments at least once a year to ensure that you’re still on the right track.

- Emotional investing — Allowing everyday stock market fluctuations to influence you can lead to impulsive investment choices. Take a deep breath and consider the facts before making any investing decisions.

- Neglecting to start — Nearly anyone can begin an investing program — even with a small budget.

FAQs about investing for beginners

Your investing options will vary depending on how much you have to spend. While some individual stocks sell for just a few dollars, mutual funds often require a relatively low minimum investment.

Brokers typically charge you a trading fee for every trade you complete. These fees can add up after a while. Brokers also charge fees for the portfolio management services they offer.

People who want to invest but have a limited budget may consider options such as opening an IRA account or signing up for their employer’s 401(k) retirement plan.

Purchasing certificates of deposits are generally considered to be less risky than many other kinds of investments.

If you have $100 you want to invest, you could consider starting an emergency fund in a high-yield savings account, contributing to your 401(k) plan, opening an IRA or investing in an exchange-traded fund (or ETF).

The S&P 500 Index, also known as the Standard & Poor’s 500, is a stock index made up of 500 of the largest companies in the United States. People typically turn to this to understand the overall performance of U.S. stocks.

What’s next: Secure funding

Now that you’re familiar with the investing process, you can decide on a goal for your initial investment. You might already have funds available to get started, but if not, you could open a high-yield savings account and contribute until you have enough to invest.

Sourcing

- Investing considerations. 10 Things to Consider Before You Make Investing Decisions (April 2023)

- Online brokers. Brokerage (December 2022)

- Robo-advisors. Robo-Advisers (January 2023)

- Robo-advisor projections. Robo-Advisors – Worldwide (April 2023)

- 401(k) contributing. Guide to Saving for Retirement (March 2023)

- Employers don’t contribute to IRAs. What Is an IRA Account? (March 2023)

- Mutual funds. What are mutual funds and how do they work? (November 2020)

- ETFs. Exchange-Traded Fund (May 2023)

- Bonds. Bonds (April 2023)

- High-yield savings accounts. 6 Best High-Yield Savings (January 2023)

- CDs. Certificate of Deposit (CD) (January 2022)

- Annuities. Annuities: Pros and cons (March 2023)

- Individual stocks. What is a Stock? (February 2023)

- Investing mistakes. Tips for Avoiding The Top 20 Common Investing Mistakes (January 2022)