In a Nutshell

Deciding how much money you should keep in a checking account depends on several factors, including your monthly expenses, any minimum balance requirements on the account, and opportunities you may have to grow your funds using different financial tools.Striking the right balance of how much money to keep in your checking account takes some planning.

Keep too little and you could run afoul of any minimum balance requirements or have trouble covering monthly bills. Leave too much in your checking account and you might miss out on opportunities to grow your money in a high-yield savings account or a certificate of deposit, or CD.

Let’s look at some factors to consider when deciding how much you should keep in your checking account.

- How much money should I have in my checking account?

- How can I calculate how much I should keep in my checking account?

- How much is too much to keep in my checking account?

- Next steps: What can I do if I’m keeping too much money in my checking account?

How much money should I have in my checking account?

How much you should keep in your checking account is an individual decision — only you can decide the amount that’s exactly right for you. But a good rule of thumb is to keep just enough in the account to cover the “musts.”

Everyday expenses

Checking accounts are designed to help you pay for things you purchase every day. You can use your debit card, rather than cash, to pay for things like groceries, your morning coffee or pet treats. You want to be sure there’s always enough in your account to cover these day-to-day costs for one to two months. Ideally, you’d have a separate emergency fund savings account where you’ve put aside three to six months’ worth of these same living expenses.

Recurring bills

Certain bills must get paid every month, such as your rent or mortgage, utility bills or your cellphone bill. Your checking account should always have enough in it to cover expenses that recur monthly.

Minimum balance requirements

Many checking accounts come with a minimum balance that you must maintain in order to avoid a monthly maintenance fee. You should keep enough in the account to ensure your balance doesn’t dip below that minimum amount and trigger fees.

Overdraft cushion

Overdrawing your account — making payments that exceed the available account balance — can cause the bank to hit you with some big overdraft fees. It’s a good idea to always have a buffer of extra money in your account to help reduce the risk of overdrawing your checking account.

How can I calculate how much I should keep in my checking account?

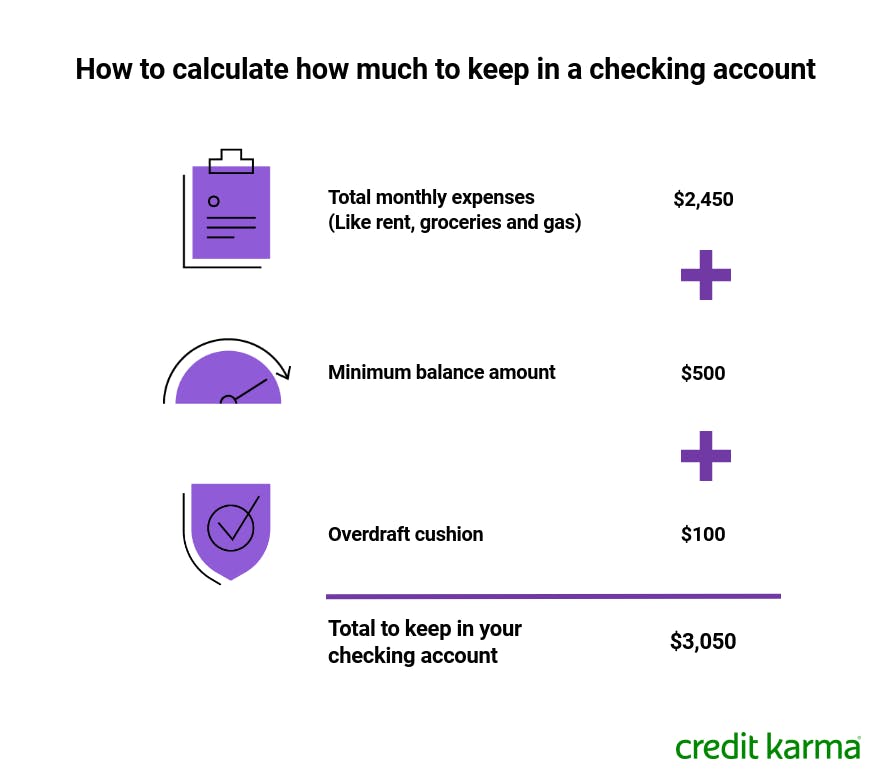

Some basic math can help you decide how much to keep in your checking account. First, add up all your expenses for a month, both recurring monthly costs and everyday spending. Next, add in your minimum balance amount (if your account has one). Finally, give yourself a cushion to prevent overdrafts. If you’ve already factored in a minimum balance amount, you may not need much of an overdraft cushion.

Here’s an example of what that calculation might look like.

Image: mnhowmuchinchecking

Image: mnhowmuchincheckingHow much is too much to keep in my checking account?

Having a lot of cash sitting in your checking account may seem like a non-issue. But while a big checking account balance might not cause you problems, you could miss some opportunities to put your money to work for you elsewhere. Many checking accounts don’t earn interest, and even those that do generally earn less interest than other types of financial products, like savings accounts or CDs.

When might you have too much in a checking account?

- If you have more than enough to cover two to three months’ worth of expenses

- If you don’t have a savings account

- If you don’t have a separate emergency fund

- If you’re missing opportunities to put your money somewhere more profitable

Should I keep all my money in one bank?

Many Americans have accounts at more than one bank. Whether you keep all your money at one bank or deal with multiple financial institutions is a personal choice — and both options have their pros and cons.

For example, putting some money in an account at a different bank may give you access to certain features that you can’t get at your primary bank. Or you may open an account at a second bank to take advantage of a higher interest rate. But keeping all your money in checking and savings accounts at the same bank may make it easier to avoid monthly maintenance and overdraft fees if the bank allows you to link your accounts.

Next steps: What can I do if I’m keeping too much money in my checking account?

If you have more money in your checking account than you need, consider relocating the excess to a financial product that could help your money grow. Here are some options to consider.

- High-yield savings account — Savings accounts generally have annual percentage yields around 0.01%. But a high-yield savings account could have a significantly higher rate — anywhere from 0.3% to 0.9%.

- Money market account — These accounts have some features of a traditional checking account but generally pay higher interest rates. As of Jan. 4, 2021, the national rate for money market accounts was around 0.07%, according to FDIC data.

- Certificate of deposit — CDs are savings vehicles that provide a set amount of interest over a certain term of months. Generally, the longer the term, the higher the interest rate. As of January 2021, the national rate was 0.04% for a one-month CD and 0.33% for a 60-month CD, according to the FDIC. Take note that any money you withdraw from a CD ahead of its maturity date could be subject to early withdrawal penalties.

- IRA — An individual retirement arrangement is a tax-advantaged account that helps you put money away for retirement. If you don’t have one but are eligible to open an IRA, you can consider opening one with your extra checking account money. Or if you have one and haven’t yet made the maximum contribution for the year, consider putting some money into the account. Take care, though: If you withdraw from your IRA before age 59 ½, the funds will be included in your gross income for the year and subject to tax — plus a 10% tax penalty unless you meet certain requirements.

Consider a free checking account

A free checking account is a basic checking account that doesn’t charge any recurring fees, such as monthly maintenance fees.

Do your research before signing up, since hidden costs can eat away at your savings. For example, you may have to pay out-of-network ATM charges, overdraft fees, foreign transaction fees and other charges or penalties.

Some accounts may even have a minimum balance requirement, meaning you have to keep a certain amount of money in your account to avoid additional charges.

If you’re looking for a checking account that’s free to open, you might want to consider a Credit Karma Money™ Spend online checking account. It comes with no penalties, overdraft fees or minimum balance requirements.

And when you set up direct deposit with Credit Karma Money™ Spend, you can get access to your paycheck up to two days early and federal benefits up to five days early.