Credit Karma MoneyTM Spend

More bank for your bucks.

It’s free to open and easy to set up.

Plus, the benefits add up with direct deposit.1

Credit Karma is not a bank. Banking services for Credit Karma Money accounts provided by MVB Bank, Inc., Member FDIC.

Image: hero-2

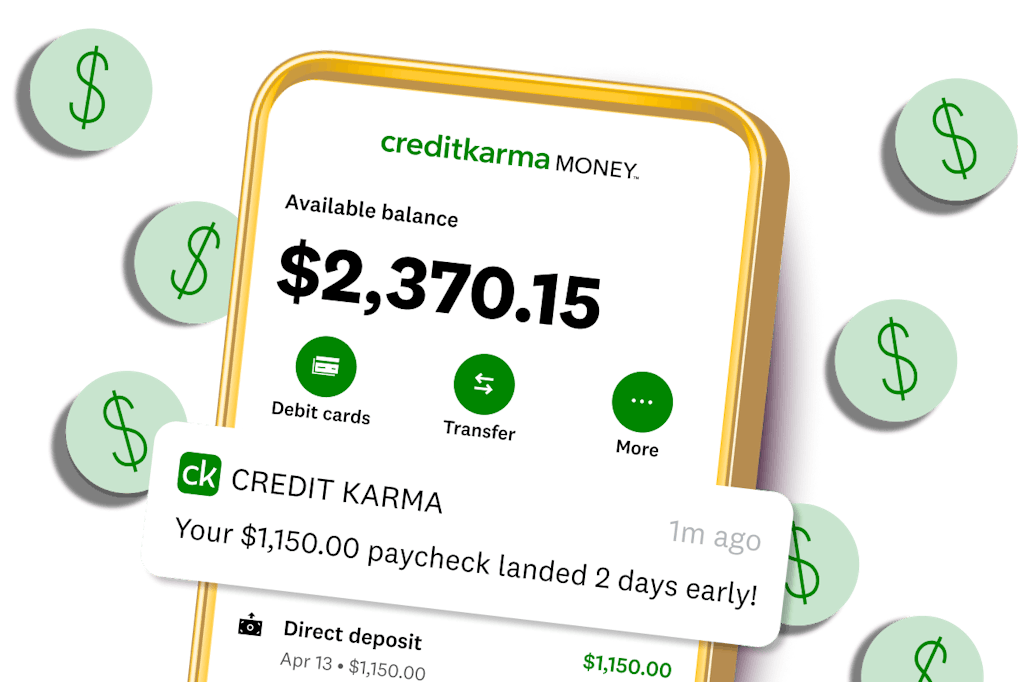

Image: hero-2More perks for your paycheck.

Set up direct deposit in as little as 3 minutes.

Image: Group 316124233

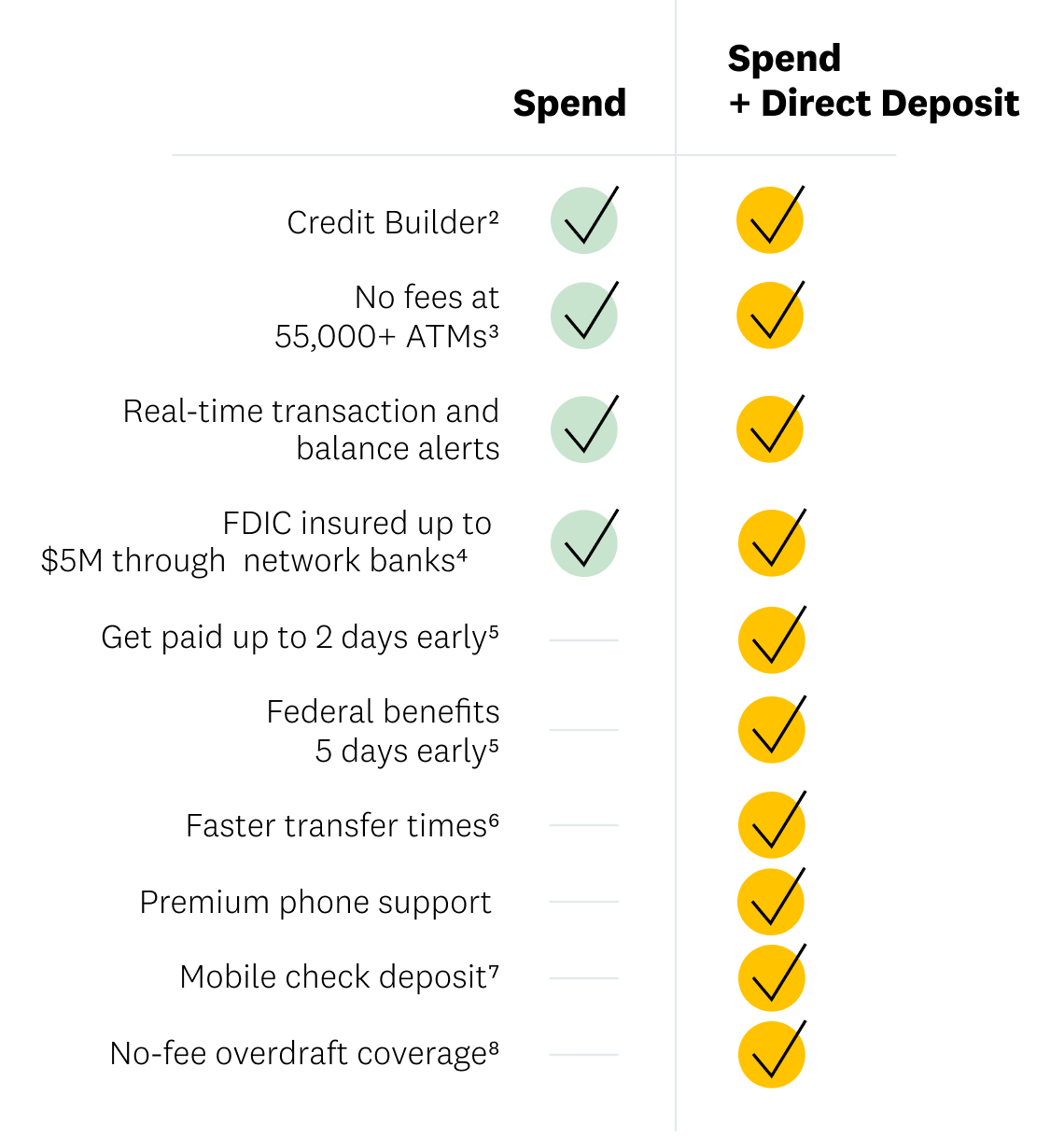

Image: Group 316124233Some Spend + Direct Deposit features may require recurring, monthly direct deposits of at least $750.

Image: Spend-CB

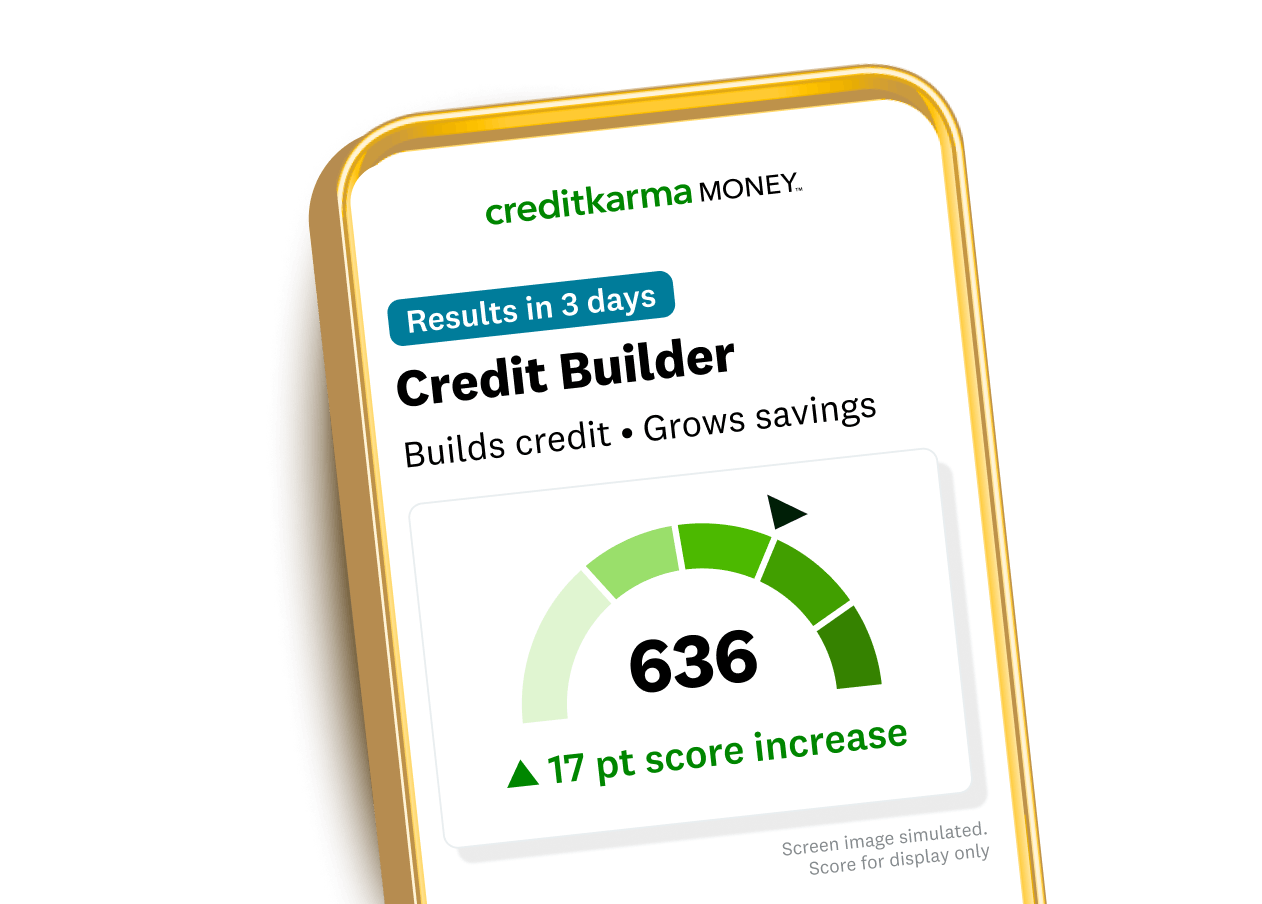

Image: Spend-CBRaise a low credit score by an average of 17 points in 3 days9 with Credit Builder.

All while building your savings. No credit check.

Members with a credit score of 619 or under may see an increase in 3 days of activating the plan. Other factors can impact your score. Banking services for Credit Builder are provided by Cross River Bank, Member FDIC. Fees may apply.

Get no-fee overdraft coverage.

Cover an unexpected charge with $20 in overdraft coverage. No fees. No interest. No credit check.

Overdraft coverage requires direct deposits of at least $750 into your Spend account per calendar month to be eligible.

Image: overdraft

Image: overdraft Image: earlypayday

Image: earlypaydayGet your paycheck up to 2 days early and federal benefits up to 5 days early.

Make smart moves with your money.

Image: icon2-2x

Image: icon2-2xInstant Transfer your money to up to 4 different accounts.10

Image: RTB-alerts

Image: RTB-alertsGet real-time transaction and balance alerts.

Image: icon3-2x

Image: icon3-2xNo fees at over 55,000 ATM locations nationwide.

Plus with direct deposit, get access to your funds in as little as 1 business day when you transfer into your account.

Boost your savings and earn a 3.10% APY11 with a Credit Karma Money Save Account.12

FAQs

A Credit Karma Money Spend account is 100% free to open, with no minimum balance requirements to open. Plus, there are no inactivity fees, no annual fees, and no monthly maintenance fees.13

Credit Karma is not a bank. We partner with MVB Bank, Inc., Member FDIC, to provide banking services supporting Credit Karma Money Spend and Credit Karma Money Save accounts.

When you open a Credit Karma Money Spend account, your funds will be deposited into an account at MVB Bank, Inc. and its deposit network. MVB Bank, Inc. is a member of the Federal Deposit Insurance Corp., and funds in your Spend account are FDIC-insured up to $5,000,000.

You can use your Spend account for electronic payments and make everyday transactions with your Credit Karma Visa® Debit Card.13 You can also deposit money from your Credit Karma Money Save account directly through the Money section of your Credit Karma account.

Additional benefits are provided to members who have set up direct deposit. You’re eligible to receive your paycheck up to 2 days early or federal benefits up to 5 days early. Plus with direct deposits of at least $750 into your Spend account per calendar month you’ll also receive additional benefits such as:

– Access to faster transfer times – access your money in as little as 1 business day when you transfer into your account

– Premium Member support – Skip the line when you call!

– Mobile Check Deposit

– $20 in Overdraft Coverage

Certain account features require you to be enrolled in direct deposit with a minimum deposit amount of $750 per calendar month. A direct deposit is an electronic deposit of compensation for services (such as payroll, salary, or government benefits) totaling at least $750 per calendar month made into your Credit Karma Money Spend account. Person to person transfers, transfers from one account to another or from other financial institutions and Instant Transfers (including Instant Transfers for Earned Wage Access) are not considered direct deposits.

Once overdraft coverage is activated, eligible members may overdraw their Spend account up to $20. We will automatically apply your next deposit towards the negative account balance. Any transactions exceeding the $20 coverage amount will automatically be declined.

If you do not have overdraft coverage activated, all transaction attempts that exceed your current account balance will automatically be declined.

With your Credit Karma Money™ Spend account, you have fee-free access to more than 55,000 Allpoint® ATMs with unlimited free withdrawals. These ATMs are conveniently located at select participating retailers like CVS Pharmacy®, Target® and Walgreens®. Allpoint® ATMs may not be available at all merchant locations. Please refer to the ATM locator in the Credit Karma app or at creditkarma.com to find the closest ATM near you.

For each cash withdrawal from an out-of-network ATM, we will charge you a $2.50 fee. This fee will be waived if you have direct deposits of at least $750 into your Spend account per calendar month. Other fees may be charged by the out-of-network ATM provider.

If you use your card to transact in foreign currencies, you’ll be charged a 1% fee of the total purchase by Visa for each transaction. This Visa International Card Fee is charged by Visa and not by Credit Karma.

All product names, logos, brands, and other trademarks are the property of their respective trademark holders.

Credit Karma uses a network of banks to provide a 100% free interest-bearing savings account with no fees. The balance in your Credit Karma Money Save account is eligible for FDIC insurance up to $5,000,000.

There’s never a minimum balance to open and maintain a Credit Karma Money Save account, and there are no hidden fees. And as long as you have at least $0.01 in your Save account, you can start earning interest today.

To open a free, FDIC-insured Credit Karma Money Save account, you’ll first need to have a Credit Karma account. You can then open a savings account through the Credit Karma app on your mobile device or desktop.

Have more questions?

Check out FAQs for Credit Karma Money™ Spend and Credit Karma Money™ Save.

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when it’s posted. Read our Editorial Guidelines to learn more about our team.

Credit Karma is not a bank. Banking services for Credit Karma Money accounts are provided by MVB Bank, Inc, Member FDIC. Maximum balance and transfer limits apply per account. Credit Builder is not provided by MVB Bank.

1Direct deposit(s) are electronic deposits of compensation for services (such as payroll, salary, or government benefits) made into your Credit Karma Money Spend account. Person to person transfers, transfers from one account to another or from other financial institutions and Instant Transfers (including Instant Transfers for Earned Wage Access) are not considered direct deposits.

2Fees may apply. Credit Builder plan requires you to open a line of credit and a Credit Builder savings account, both banking services provided by Cross River Bank, Member FDIC. Credit Builder savings account is a deposit product, insured up to $250,000. Credit Builder is serviced by Credit Karma Credit Builder. Members with a TransUnion credit score of 619 or below at the time of application may be prompted to apply for Credit Builder. If your score increases over 619, you may no longer see these prompts.

3Free withdrawals available at select ATMs in the Allpoint® network. We charge a $2.50 fee for each ATM withdrawal outside this network. This fee is waived with direct deposits of at least $750 into your Spend account per calendar month. Other third party fees may apply for ATM transactions outside this network.

4Credit Karma is not a bank. Through our bank partners, the balance in your checking and savings accounts may be moved to one or more network banks, as listed here, where it is eligible for FDIC insurance up to $5,000,000 once the funds arrive at network banks. Actual insured amounts may be lower or adversely affected based on any balances you hold in other accounts at other network banks, as each network bank provides up to $250,000 of FDIC insurance coverage per qualified account ownership category. Learn more at: https://www.fdic.gov/deposit/deposits.

5Early access to paycheck or federal government benefits is compared to standard electronic deposit and is dependent on and subject to payor submitting payroll or benefit payment information to the bank before release date. Payor may not submit payment information early.

6Direct deposits of at least $750 into your Spend account per calendar month to be eligible. ACH transfer times are faster as compared to our standard transfer time, which is up to 3 business days after ACH settlement. Access to faster transfer times is subject to transaction amounts and other risk-based factors determined by Credit Karma Money using internal confidential information, including your account history.

7Direct deposits of at least $750 into your Spend account per calendar month to be eligible. Mobile check deposit is only available through the Credit Karma app and is subject to verification and deposit limits. Funds may not be available for immediate withdrawal. Other restrictions apply. Your mobile carrier’s message and data rates may apply.

8Direct deposits of at least $750 into your Spend account per calendar month to be eligible. No fee to use. Discontinue any time. Overdraft Coverage allows us to consider paying your ACH, debit card and ATM transactions that would have otherwise declined due to insufficient funds. Your next deposit will be automatically applied to your negative balance. Overdraft coverage does not apply for bill payments through the Credit Karma platform, or internal or external transfers. Limits may change daily. Use responsibly. Learn more here.

9 From June 2024 to November 2024, members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 17 points in 3 days of activating the plan. Late payments and other factors can have a negative impact on your score, including activity with your other credit accounts.

10Typically deposited within 30 mins. Subject to 1.75% fee, with a $0.25 minimum. Transactions monitored and may be held, delayed or blocked for risk or other reasons. Limits and tiers apply. Full terms see Deposit Account Agreement

11The Annual Percentage Yield (APY) shown is current as of 12/19/2024. This rate is variable and may change. No minimum deposit to open account. Balance must be at least $0.01 to earn APY. A maximum of 6 withdrawals per monthly statement cycle may apply.

12A maximum of 6 withdrawals per monthly savings statement cycle may apply.

13Other fees may apply. Please see Spend Account Terms & Disclosures for more information.

14Credit Karma Visa® Debit Card issued by MVB Bank, Inc., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa terms and conditions apply.