Missed the tax deadline?

We got you.

Credit Karma and TurboTax are joining forces to help you file fast and get your max refund, so you can stop stressing and start making progress.

Image: 7295-image-1

Image: 7295-image-1 Image: 7295-image-2a

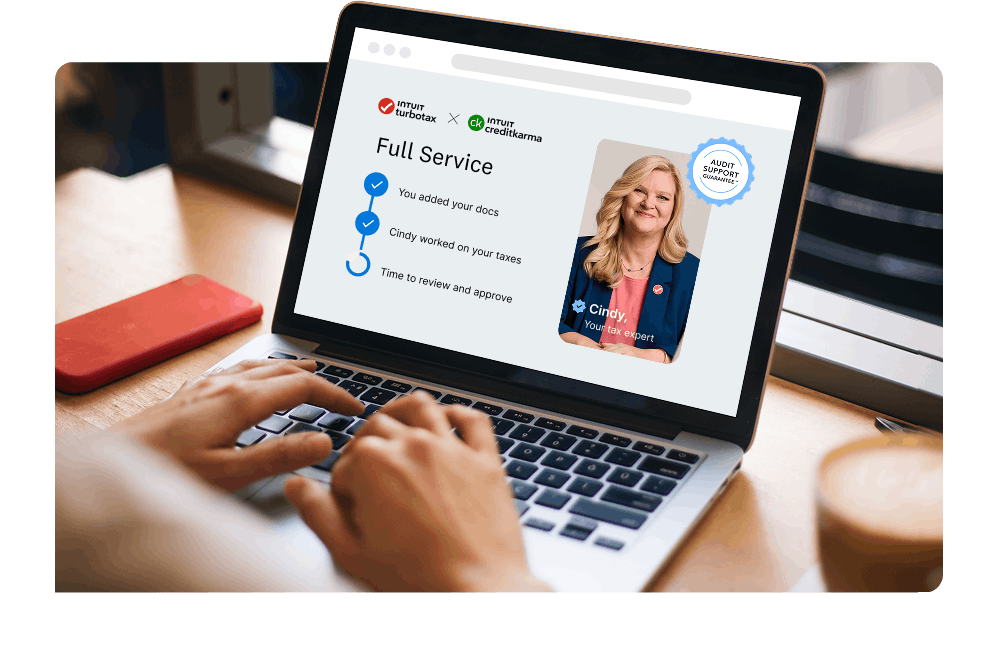

Image: 7295-image-2aExpert help before, during and way after tax season.

Whether you want a second pair of eyes right before you file, full-on guidance from start to finish, or year-round support, certified TurboTax experts are here to help when you need them.1

Get your max refund or get your money back.2 Seriously.

From student loan interest to property taxes, we’ll help you claim every deduction, every credit, and every dollar you qualify for.

Image: 7295-image-3

Image: 7295-image-3*Not indicative of your actual refund. National average based on 2024 IRS data as of 3/29/24.

Image: 7295-image-4

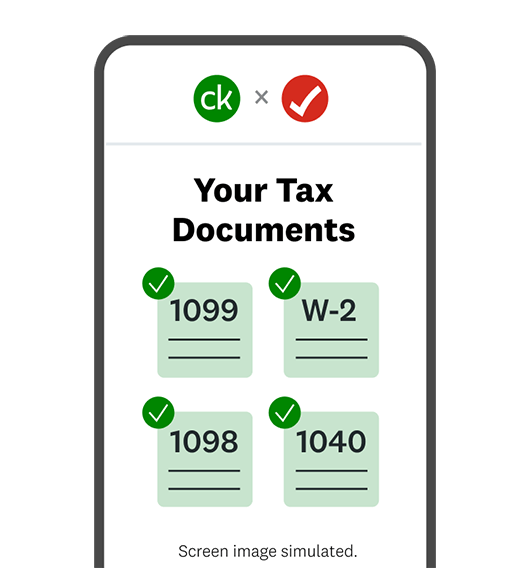

Image: 7295-image-4Take the work out of paperwork.

Upload your tax forms in seconds. Just snap a pic with your phone and we’ll help you get started.3

More helpful tax tips from our editors:

Image: 7295-icon-1

Image: 7295-icon-1 Image: 7295-icon-2

Image: 7295-icon-2 Image: 7295-icon-3

Image: 7295-icon-3 Image: 7295-icon-4

Image: 7295-icon-4 Image: 7295-icon-5

Image: 7295-icon-5 Image: 7295-icon-6

Image: 7295-icon-6The capital gains tax rate: How it’s different than tax on other income

Image: 7295-icon-7

Image: 7295-icon-7Try these tips to go from a “tax season” mindset to a “tax year” approach

1Available with select products. See pricing on Intuit TurboTax.

2If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we’ll refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax, or until December 15, 2025 for your 2024 business tax return. Additional terms and limitations apply. See Terms of Service for details.

3With streamlined TurboTax experience for Credit Karma Members. May not be available for all members.